The number of Wrapped Bitcoin on Ethereum, also known as WBTC, is surging. It shows a rapid increase in users utilizing WBTC on Decentralized Finance (DeFi) protocols.

Citing data from Dune Analytics and CoinMetrics, cryptocurrency analyst Zack Voell reported that the issuance of WBTC surpassed the amount of Bitcoin mined since August 9.

The data coincide with a substantial spike of the total value locked on DeFi protocols. In the past week, the amount of capital locked in DeFi platforms increased from $4.55 billion to $5.95 billion, by nearly $1.5 billion.

Growing DeFi demand directly affects Wrapped Bitcoin

WBTC is a token that represents the value of Bitcoin launched on the mainnet of Ethereum in early 2019. Various companies, including Compound, MakerDAO, Ren, and Dharma, contributed to the launch of WBTC.

Since users cannot directly transfer Bitcoin to the Ethereum blockchain, users first convert Bitcoin to WBTC, and then utilize DeFi platforms with it.

The demand for WBTC has increased in recent weeks as the user activity in the DeFi space significantly increased. The emergence of new projects and the overall rise in awareness caused both the DeFi ecosystem and WBTC to grow in tandem.

Loong Wang, the chief technical officer of Ren, said:

“Bitcoin is now an undeniable part of DeFi, with $420M USD of BTC on Ethereum, in one form or another. In the last 24 hours, over $24M has been moved through Ren to be used to farm yield. Anyone not generating APY right now with their BTC is asleep.”

Max Bronstein, who leads the institutional and ventures arm at Coinbase, explained that users are holding BTC on Ethereum due to various incentives.

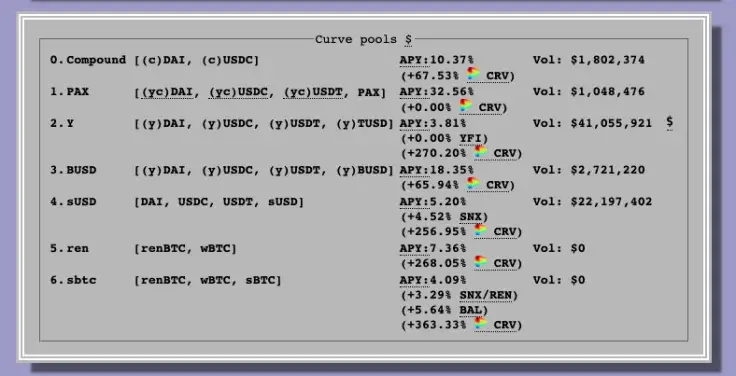

For example, Bronstein pointed out that participants in the Curve Finance platform are paid more than 1% a day to long Bitcoin. He said:

“The opportunity cost of not holding BTC on Ethereum is incredibly high, participants in the sBTC pool on Curve Finance are being paid over 1% a day to be long Bitcoin.”

The incentives on DeFi platforms of holding Bitcoin is contributing to the growing demand for WBTC. There are other types of assets in the DeFi ecosystem that represent the value of Bitcoin, but WBTC remains the largest.

But some analysts remain skeptical towards the long-term trend of WBTC. Joseph Todaro, the head of research at TradeBlock, said he does not see a compelling case for WBTC in the long run. He explained:

“I don't see a compelling case for WBTC long term. The comparison to tether is not appropriate. There is no way to custody dollars on ETH w/o trust. We can custody BTC on ETH though. Once the contracts securing BTC on ETH have been battle tested, seems little need for WBTC.”

In the near-term, the expanding DeFi market raises the chances of the demand for WBTC growing. In the longer-term, whether the trend is sustainable remains uncertain for now

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov