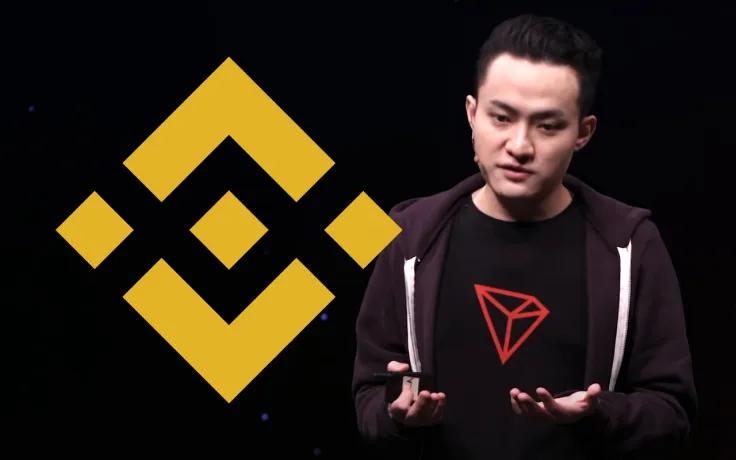

Renowned crypto entrepreneur Justin Sun made headlines with a massive transaction that was authorized by his account. Is Tron's founder ready to sell?

Justin Sun deposits $55 million to Binance

Blockchain journalist and insider Colin Wu shared the details of a massive Ethereum (ETH) transaction that took place on crypto exchange Binance (BNB).

At 21:00 on March 2 (UTC+8), Justin Sun’s address (0x176F3DAb24a159341c0509bB36B833E7fdd0a132) transferred 19,000 ETH to Binance, with a total value of about $55 million. Link: https://t.co/aJMRRBhWJc?from=article-links

— Wu Blockchain (@WuBlockchain) March 3, 2022

The transaction was registered on March 2, 2022, at 9:00 p.m. (UTC+8). A total of 19,000 Ethers (ETH) with a total value over $55,000,000 were moved to Binance by Justin Sun, Tron's founder.

As covered by U.Today previously, Mr. Sun's account was very active in December 2021. In less than one month, he deposited more than $600 million worth of Ethereum (ETH) to Binance (BNB).

However, it appeared that Mr. Sun moved coins between internal wallets of his ecosystem with no intention to sell.

Is this a bearish sign?

Nevertheless, some Crypto Twitter speakers are certain that this is an alarming signal for Ethereum (ETH) bulls. It was mentioned that the activity of Three Arrow Capital's Su Zhu should also be monitored closely.

@zhusu @justinsuntron Beware guys , these 2 are always talking bullish on Twitter while unloading coins in the background.

As we already reported, the activity of known large whales is often interpreted as a major signal for retail crypto holders. For instance, on Nov. 11 at 2:56 p.m. (UTC), the Ethereum Foundation sold $90 million right on the top of its price upsurge.

Analyst Edward Morra stressed that this is not the first time that EF cashed out its bags at the top.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team