Veteran commodity trader Peter Brandt recently took another shot at XRP by comparing it to the U.S. Dollar, the world's reserve currency, in a caustic tweet.

Sadly for the #XRPtheStandard crowd, the chartist didn’t mean to flatter the fourth largest cryptocurrency with such an unorthodox comparison.

The story of two bagholders

Brandt draws parallels between the U.S. Federal Reserve and Ripple, the San Francisco-based company behind XRP, to make his point valid:

“The Fed is the USD's bag holder -- they can double the supply if they want. Ripple is XRP's bag holder -- and it WILL double the supply.”

Advertisement

The Fed is responsible for managing the money supply in the U.S, which has ballooned by trillions of dollars over the past decade. Its balance sheet is expected to grow to close to $10 trln by 2021 after Chairman Jerome Powell started firing on all cylinders to support financial markets and soften the blow from this year’s crisis.

Some consider Fed’s fast and furious money printing reckless while advocating for the return of the gold standard that Brandt doesn’t think is coming back.

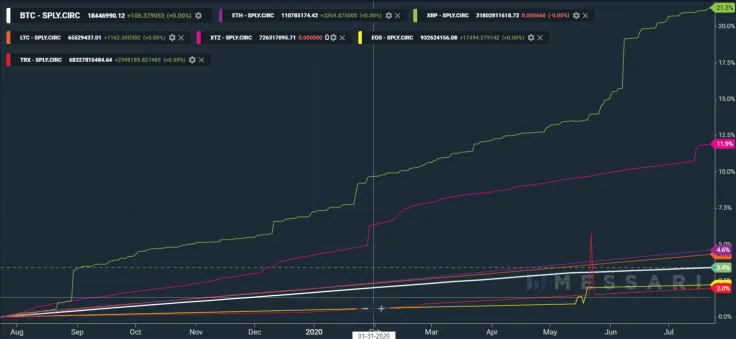

Ripple, as Brandt notes, is the main “bagholder” of XRP that controls the lion’s share of the token’s supply while unlocking 1 bln XRP tokens on a monthly basis. Ripple’s position is that it discovered XRP and cannot influence its price.

According to data provided by crypto research firm Messari, XRP’s inflation rate currently stands at a whopping 21.3 percent (compared to Bitcoin’s 3.4 percent).

Brandt is not opposed to crypto

As reported by U.Today, Brandt previously called XRP “a manipulated XRP” whose price action is only supported by Ripple.

While the chartist believes that XRP is “a dead end,” he is actually “super bullish” on Bitcoin and Ethereum.

That said, he recently mentioned that it would be arrogant for the crypto community to believe that any of their “pet rock” would be able to solely replace fiat money.

Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya