Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

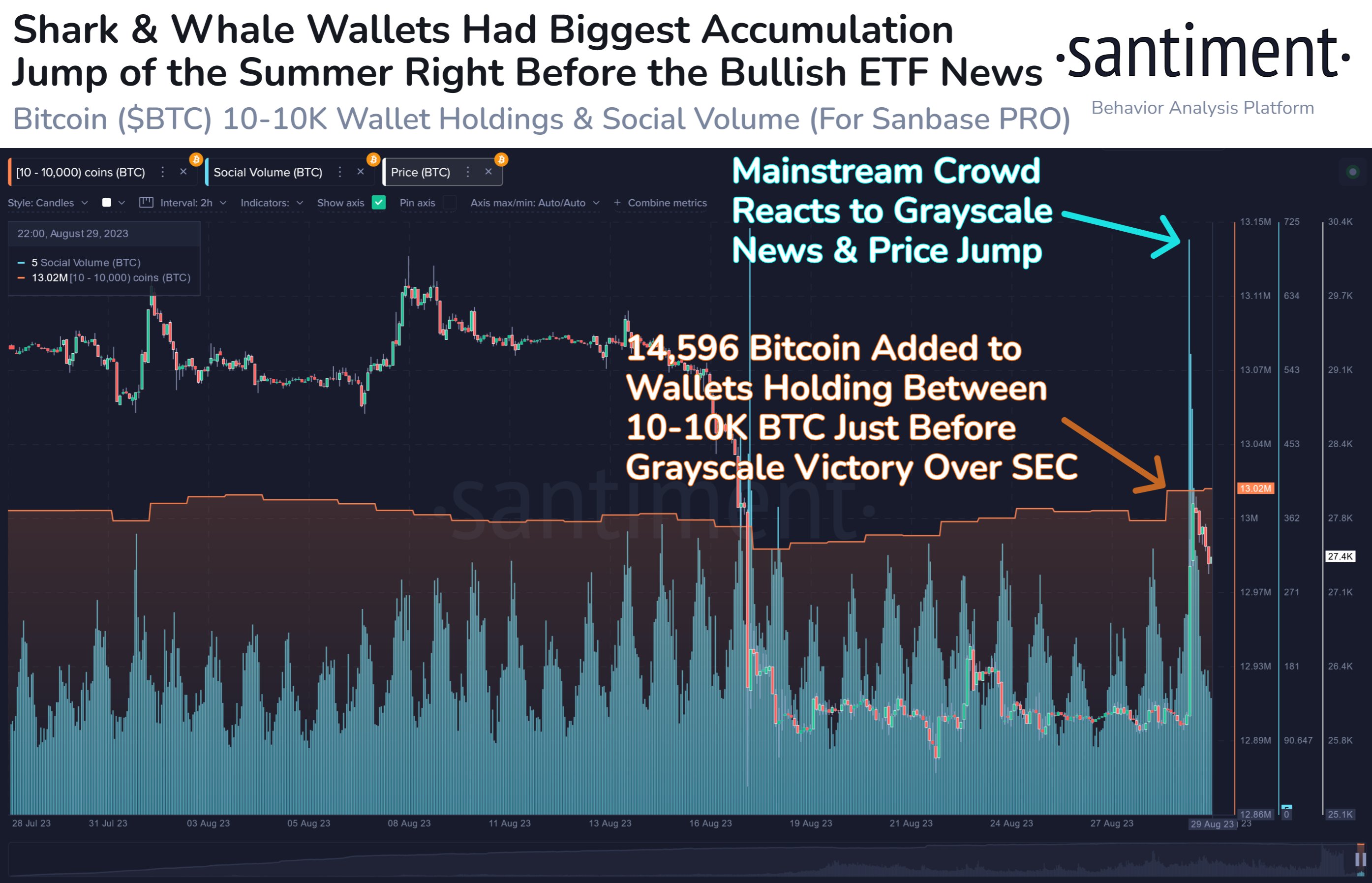

In a stunning turn of events, insiders appear to have gained a significant edge on the crypto markets, with data from Santiment revealing a remarkable accumulation surge within shark and whale wallets. This noteworthy uptick in accumulation occurred right before the breaking news of the landmark Grayscale v. SEC ruling.

The timing could not have been more precise, as individuals behind wallets containing between 10 and 10,000 BTC amassed a staggering $388.3 million, equivalent to 14,596 BTC, in Bitcoin on the day leading up to the announcement. As a result, this accumulation craze was rewarded handsomely, with Bitcoin's price experiencing a 6% surge, reaching a two-week pinnacle of $28,142 per BTC.

As reported by U.Today, Grayscale emerged victorious in a courtroom battle against the SEC, regarding the listing of Bitcoin futures products. The court's decision underscored the regulator's failure to provide a sufficient rationale for approving the futures products while rejecting Grayscale's Spot BTC ETF offering.

The win, however, does not guarantee an immediate green light for Grayscale's conversion of its GBTC trust into a Spot Bitcoin ETF. Instead, it mandates the SEC to reassess its rejection of Grayscale's application. It is worth mentioning that Grayscale's GBTC trust is the largest Bitcoin holder among all funds at the moment with over 600,000 BTC on their balance sheet.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov