Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The price performance of Shiba Inu was far from being bullish or even positive lately. The asset is clearly losing touch with the market and has failed to regain ground above the local support level at approximately $0.000025. The exodus of whales clearly shows that the market is not ready for a growth phase yet.

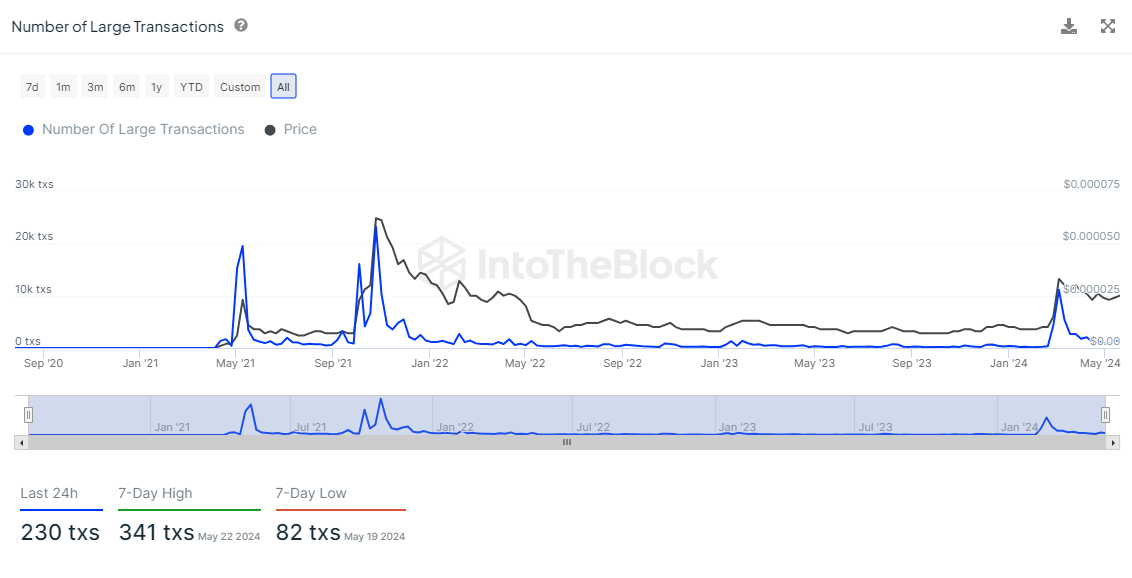

Shiba Inu has recently capitulated to strong selling pressure that brought the price below key support areas. The price declined to around $0.0000239 as it failed to hold a position above the $0.000025 level. This coincided with a decline in large transactions, signaling a drop in activity by whales.

For example, from the seven-day high of 341 transactions, there have just been 82 large transactions conducted over the last 24 hours. This decrease in the number of high-value transactions suggests that big holders, or whales, lighten up their positions, and it weakens the buying pressure required to sustain higher prices.

At the same time, the volume of large transactions for the past 24 hours amounted to 3.36 trillion SHIB compared to the 5.7 trillion SHIB peak in seven days. That means, in general terms, some relief as far as the activity of big holders is concerned, which still hints at bearish pressure.

To add a few more concerns regarding the token's summary: first is the fact that only 61% of holders remain in the black at the price level, while 35% are out of the money. The concentration by large holders is still very high at 73%, but the diminishing transaction volume is a good indication of the increased activity of large holders.

Another problematic level would be a possible bearish cross of the 50-day and 100-day EMAs. An even worse break below such a level would likely encourage selling pressure that would push SHIB to further lows of support around $0.000022 and quite possibly down to $0.000018.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin