Shiba Inu is continuously losing its backbone as the number of SHIB billionaire holders is plummeting. Per recent data, this select group is shrinking rapidly.

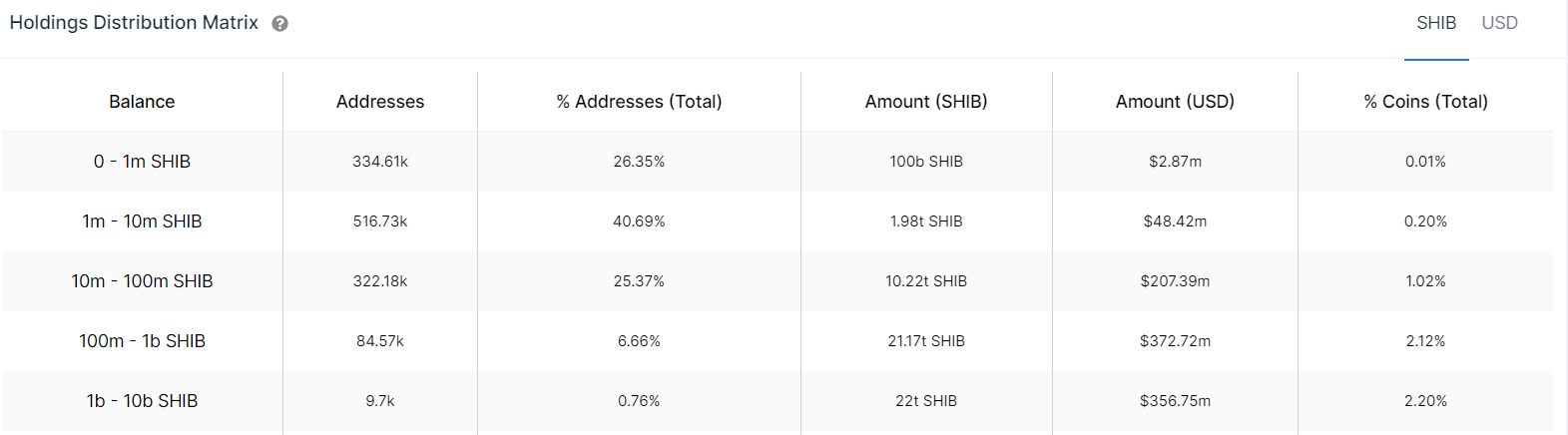

Per recent statistics, only 0.7% of SHIB holders can now be considered billionaires in SHIB terms. This fall in the percentage of substantial holders is a clear indication that profit-taking is becoming a dominant trend on the SHIB market.

Interestingly, even as the percentage of large SHIB holders is diminishing, certain metrics such as large holders' netflow show a different story. The seven-day change in large holders' netflow stands at a whopping +1,024.86%, which typically signals an increase in buying pressure. On the other hand, the 30-day change presents a different picture with a -22.71% decrease. Despite this roller-coaster of changes, over a more extended period, the 90-day change showcases an overall positive trend of +199.49%.

However, these percentages can be misleading. Despite these large percent changes, the actual increase in the volume of SHIB is far less significant. This discrepancy can be attributed to the volatility of the crypto market and the immense supply of SHIB, which currently stands at one quadrillion coins.

The declining number of billionaire holders and the increased profit-taking behavior indicate a significant shift in SHIB market dynamics. It suggests that while a small number of investors continue to hold massive amounts of SHIB, many are choosing to secure profits, thereby contributing to increased market volatility.

As always, investing in cryptocurrencies, particularly meme coins like Shiba Inu, is risky due to their highly speculative nature. Investors must stay informed and carry out their due diligence before making any investment decisions. As it stands, only a minuscule portion of SHIB investors fall into the billionaire category, reflecting the shifting dynamics of this unpredictable market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov