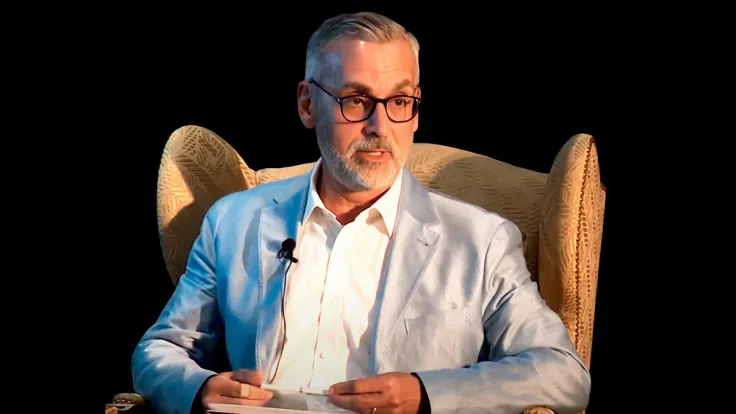

Stuart Alderoty, Ripple's top lawyer, took aim at the SEC's controversial "crypto asset security" term in his recent social media post.

Alderoty argues that this is a fabricated term without any legal basis.

"The SEC needs to stop trying to deceive judges by using it," he stressed.

As noted by Alex Thorn, head of research at prominent crypto firm Galaxy Digital, the agency is once again reserving the right to claim that USD-backed stablecoins are "crypto asset securities."

This came after it dropped its enforcement action against stablecoin firm Paxos. The firm was at loggerheads with the SEC over the BUSD that was issued in partnership with Binance.

Thorn was highly critical of the SEC, describing its recent action as "the height of jurisdictional overreach."

"The SEC doesn’t even make a case here. They are just unwilling to let it go. It’s a bludgeon they must keep sharp..." he said.

Last December, Judge Jed Rakoff ruled that Terra's UST stablecoin was an unregistered security in a significant win for the SEC. However, as noted by Thorn, this was related only to algorithmic stablecoins.

As reported by U.Today, Ripple's own RLUSD stablecoin recently entered a beta testing phase. The much-anticipated project is expected to go live later this year on the XRP Ledger and Ethereum.

Ripple's foray into the stablecoin market is likely to attract more regulatory scrutiny. The SEC has already targeted Ripple's dollar-backed cryptocurrency, describing it as an "unregistered crypto asset" in one of its legal filings.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov