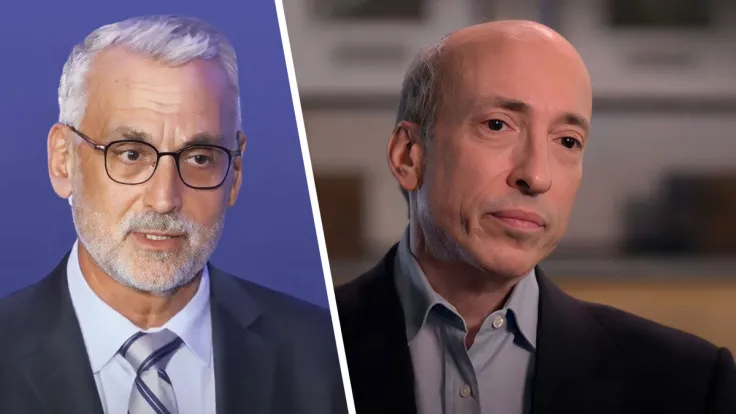

Ripple's chief legal officer, Stuart Alderoty, has said that the current head of the U.S. Securities and Exchange Commission, Gary Gensler, should recuse himself from any case involving cryptocurrencies and unregistered securities. Alderoty based his claim on the precedent set in Anthony v. SEC from 1989.

The main argument of the Ripple representative is that Gensler has repeatedly stated that all cryptocurrencies other than Bitcoin (BTC) are unregistered securities. Thus, says Alderoty, the SEC chief prejudged the outcome of the case. According to the case to which he is referring, Gensler must now recuse himself, as such statements violate due process.

Then in 1989, the court ruled in favor of the plaintiff against the SEC, reversing part of the earlier decision and remitting the case for reconsideration with instructions for the SEC to reexamine the evidence without any participation from a biased commissioner.

Crypto lawyers' reactions

Other members of the legal alliance in the XRP community have commented differently on Alderoty's statement. Thus, crypto lawyer and representative of XRP holders John Deaton said that the SEC will probably not comment on the claim in any way, as it always does in cases of conflict of interest.

Another pro-crypto lawyer, Jeremy Hogan, ironically stated that it means everything is OK, as Gensler was making these comments as a long-distance runner and orange juice enthusiast rather than as head of the commission.

Alex Dovbnya

Alex Dovbnya Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin