Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

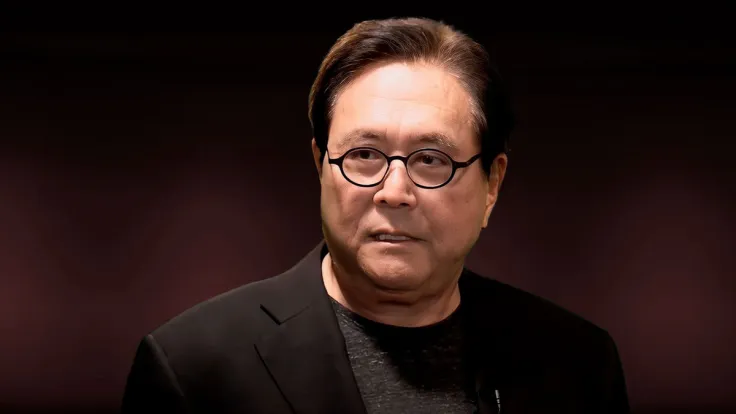

Vocal Bitcoin advocate, entrepreneur and financial guru famous for his book "Rich Dad Poor Dad," Robert Kiyosaki, has taken to the X social media app to talk about "fake USD" that the U.S. government keeps printing and which, he believes, may lead to a massive economic crash. He plans to discuss it on a new podcast this week.

Robert Kiyosaki to share his warning on new podcast

Kiyosaki tweeted that he has been invited to a new podcast run by Daniella Cambone, a former employee of Kitco and Stansberry Research, who decided to leave these companies and start her own podcast.

Kiyosaki will be the guest on the first episode that will go on the air this Friday. He promised that on that podcast, he will talk about "how to thrive" and about "the lies the US is telling about the failing economy and printing fake money."

Fed buys gold but Bitcoin is better: Kiyosaki

In a tweet published earlier this week, Robert Kiyosaki addressed the fact that central banks of various countries (he named the U.S. Federal Reserve as an example) have started to buy gold. The financial guru stated that this by no means suggests that fiat money is safe now. Central banks are buying gold, he claims, to save themselves from their own incompetence.

The safe haven assets that can protect ordinary investors from "central bankers" are gold, silver and Bitcoin. In the comment thread, some members of the crypto community also suggested that Litecoin and XRP could be good options when it comes to cryptocurrencies. However, Kiyosaki is not discussing altcoins, even Ethereum – he only speaks about Bitcoin in his tweets and urges his army of followers to buy it.

On Nov. 10, he issued a tweet, saying that he continues to buy more Bitcoin, silver and gold, since the U.S. government ("the leaders") are pushing average people into poverty. He also urged his followers to take care of themselves and, therefore, save the aforementioned assets, including BTC.

Cathie Wood sees Bitcoin hitting $600,000

This week, the chief executive of Ark Invest, vocal Bitcoin supporter Cathie Wood, made a stunning Bitcoin price prediction, expecting the leading digital currency to soar as high as $600,000 per coin.

The renowned investor made that statement during her interview with Yahoo! Finance. Wood believes that BTC will eventually hit this predicted price since its power originates from its scarcity and the large interest financial institutions have developed in BTC recently.

Ark Invest was among the institutions that filed for a Bitcoin spot ETF this year with the SEC. Actually, Ark Invest was the first to do that, and the deadline for the decision on that has been extended by the regulator until next year. However, some experts believe that the SEC may issue an approval for a BTC spot ETF as early as this year or in early January. Currently, the regulator has around a dozen filings on its desk, including one from Ark Invest, BlackRock, VanEck, Grayscale and other institutions.

Once a Bitcoin spot ETF gets the green light, the Bitcoin price will go on a massive rally, the crypto community expects.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin