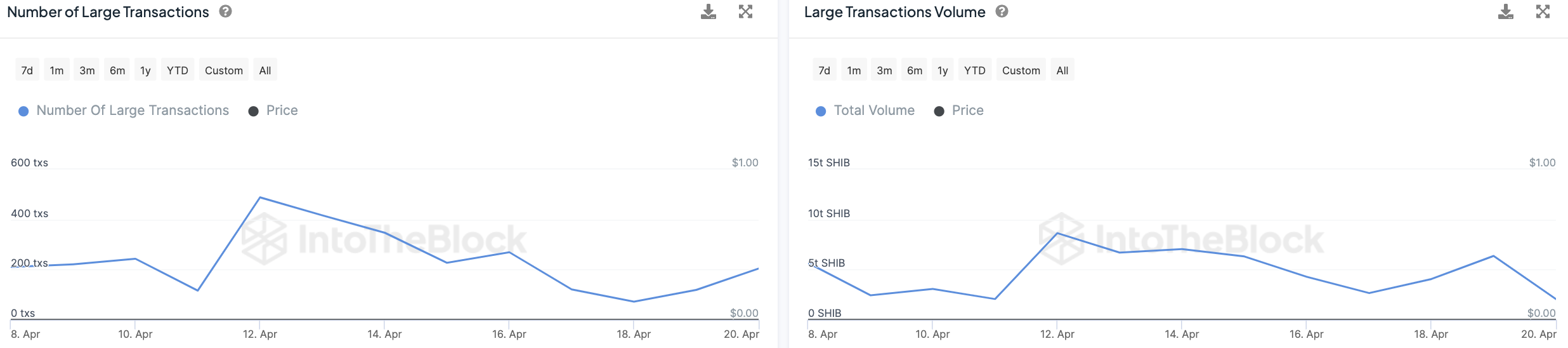

A rare anomaly has emerged in the Shiba Inu (SHIB) ecosystem, causing a significant disruption in one of its key whale metrics. Data from IntoTheBlock has uncovered a peculiar trend, showcasing a notable increase in the number of large transactions exceeding $100,000 within the past 24 hours.

However, despite this surge in transaction frequency, there has been a substantial decline in the volume of these transactions during the same period.

According to the data, the number of large transactions soared by an astonishing 71.4%, totaling 204 transactions. This surge in activity would typically suggest a robust and bullish market sentiment among large-scale investors.

However, the anomaly lies in the stark contrast observed in the volume of these transactions. The volume of large transactions, denoted in Shiba Inu tokens, plummeted by a staggering 67.3%, decreasing from 6.36 trillion SHIB to 2.08 trillion SHIB.

Divergence

Furthermore, when measured in dollar equivalent, the decline in transaction volume amounted to 63.63%, dropping from $144.76 million to $52.64 million. Interestingly, the percentage of volume decline in dollar terms appears lower due to the substantial price surge of the Shiba Inu token.

Within the same 24-hour period, the token's price experienced a remarkable increase of over 24%, briefly reaching $0.0000282 before retracing to $0.0000262.

The perplexing nature of this anomaly may leave the SHIB community questioning its underlying cause. Whether this unexpected turn of events stems from a glitch in the on-chain data calculations or if it signifies a genuine and unprecedented occurrence within the Shiba Inu ecosystem is a question to ask.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin