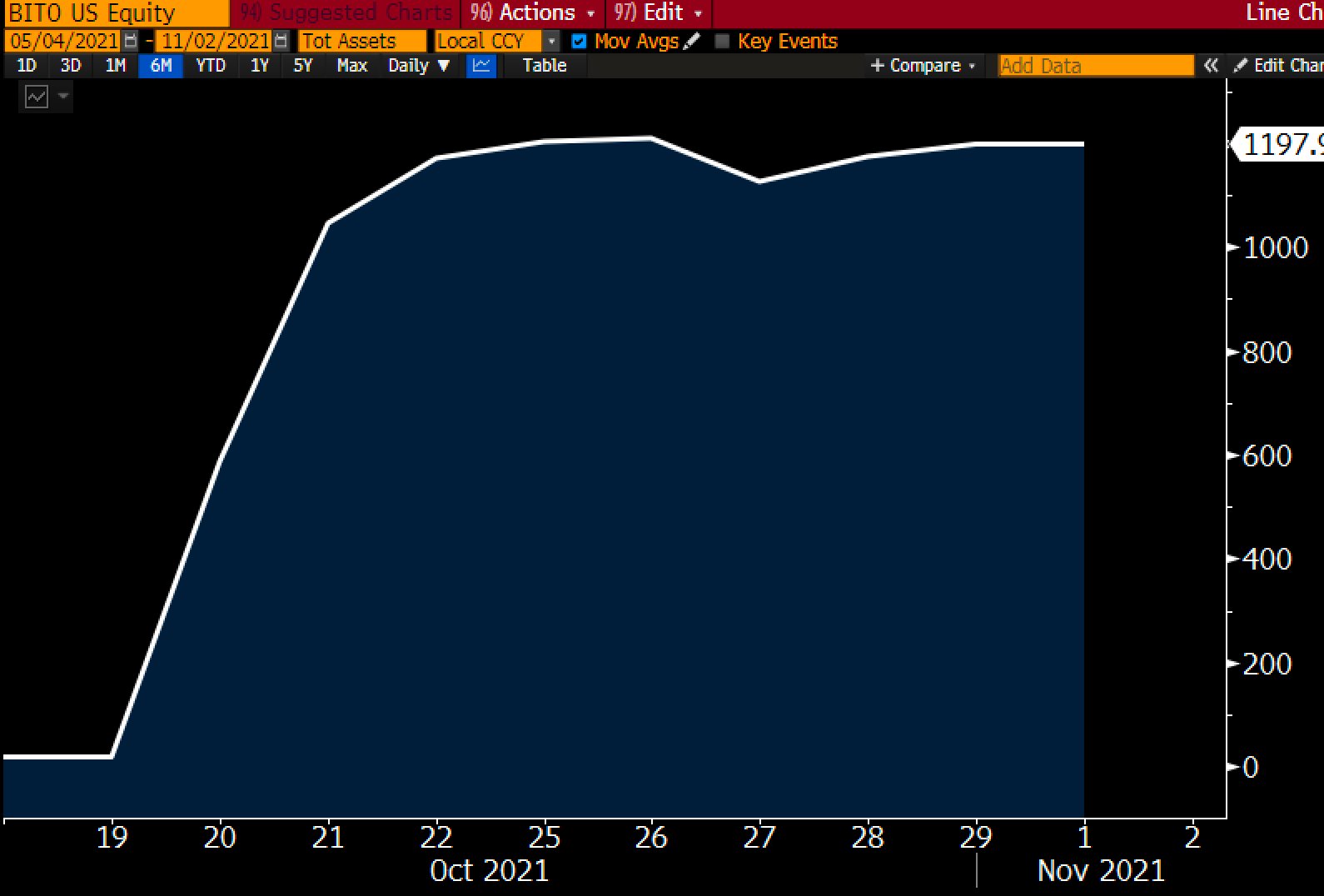

The most recent launch of the ProShares Bitcoin ETF shook up the cryptocurrency industry with record-breaking $1.2 billion inflows being injected into the cryptocurrency market. But in the previous week, ProShares has failed to attract more funds from investors.

ProShares' BITO holdings have plateaued at $1.1 billion after a week of active trading. According to the analyst's post, the fund is still trading over $200 million a day, which is an above-average result for the new ETF.

Young funds with large capitalizations are usually followed by steady inflows over numerous trading days, but in BITO's case, no inflows are being tracked, which raises analysts' concerns. Previously, numerous experts expressed their thoughts about the possibility of low demand for futures-based products.

But in comparison to other investment products like Grayscale Bitcoin Fund, ProShares exchange-traded fund trades with higher volume. But, according to Bloomberg analysts, it fails to penetrate big advisor money.

The main reason for falling demand is the underlying issues that futures-backed ETFs bring, including contango bleed, higher rolling costs and tracking issues. In addition to all that, Bitcoin does not require any specific knowledge or documentation to gain direct exposure to it.

The only solution for those problems is a physically-backed fund, which is not being close to being approved by the SEC. Previously, Valkyrie's physically-backed Bitcoin ETF was postponed by the SEC. The approval of the physically-backed Bitcoin ETF will most likely not take place until U.S. regulators find a way to properly regulate the cryptocurrency market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov