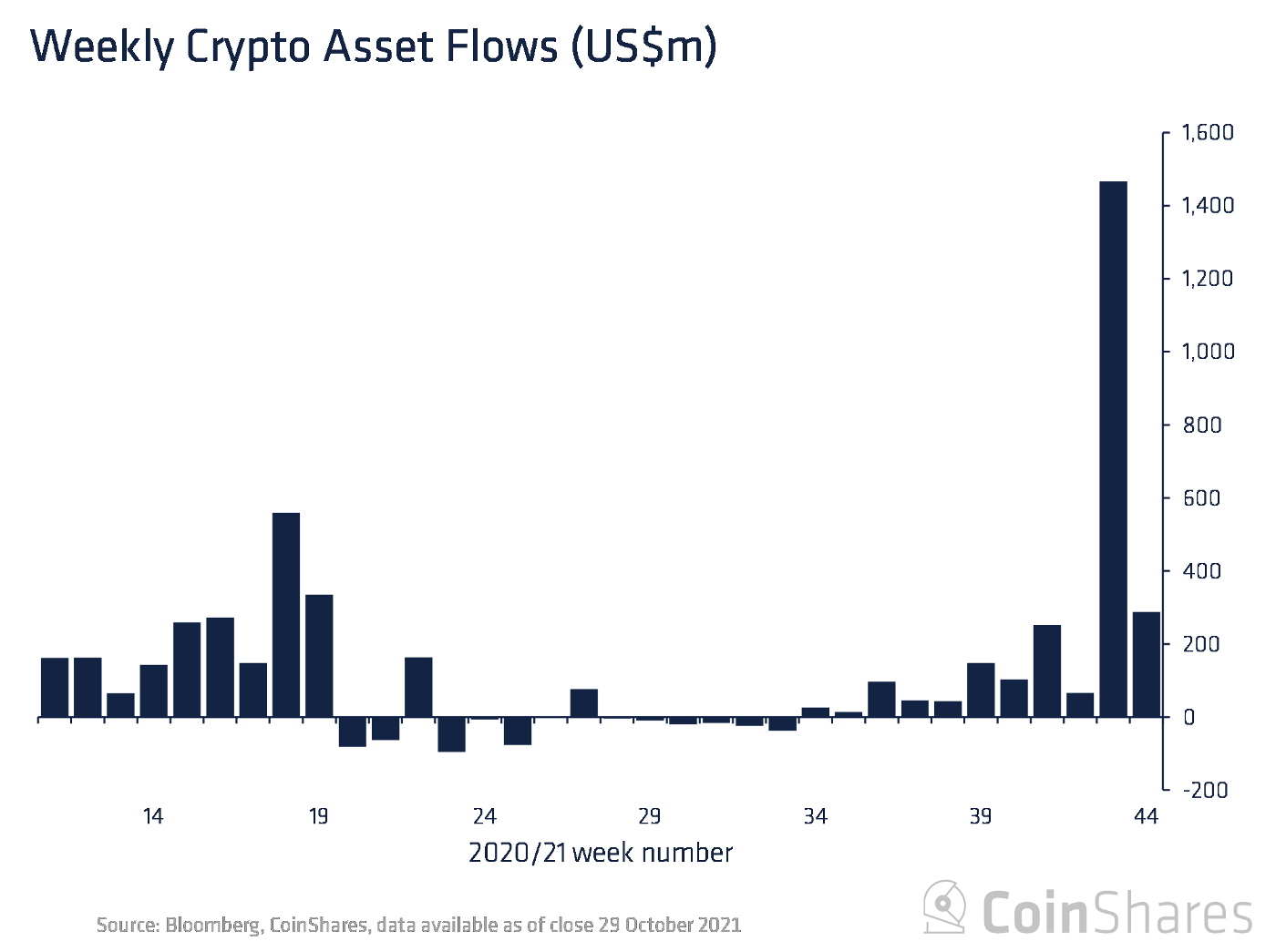

Following the approval and trading initiation of ProShares Bitcoin Futures ETF, the industry faced almost $1.5 billion inflows with the ETF bringing in $1.2 billion singlehandedly. But this week, U.S. inflows have cooled down to around $50 million, according to CoinShares.

Institutional investments in digital assets have totaled $288 million in the last week, making it almost $9 billion YTD. In comparison to the previous week, total funds invested have been reduced by approximately 20%.

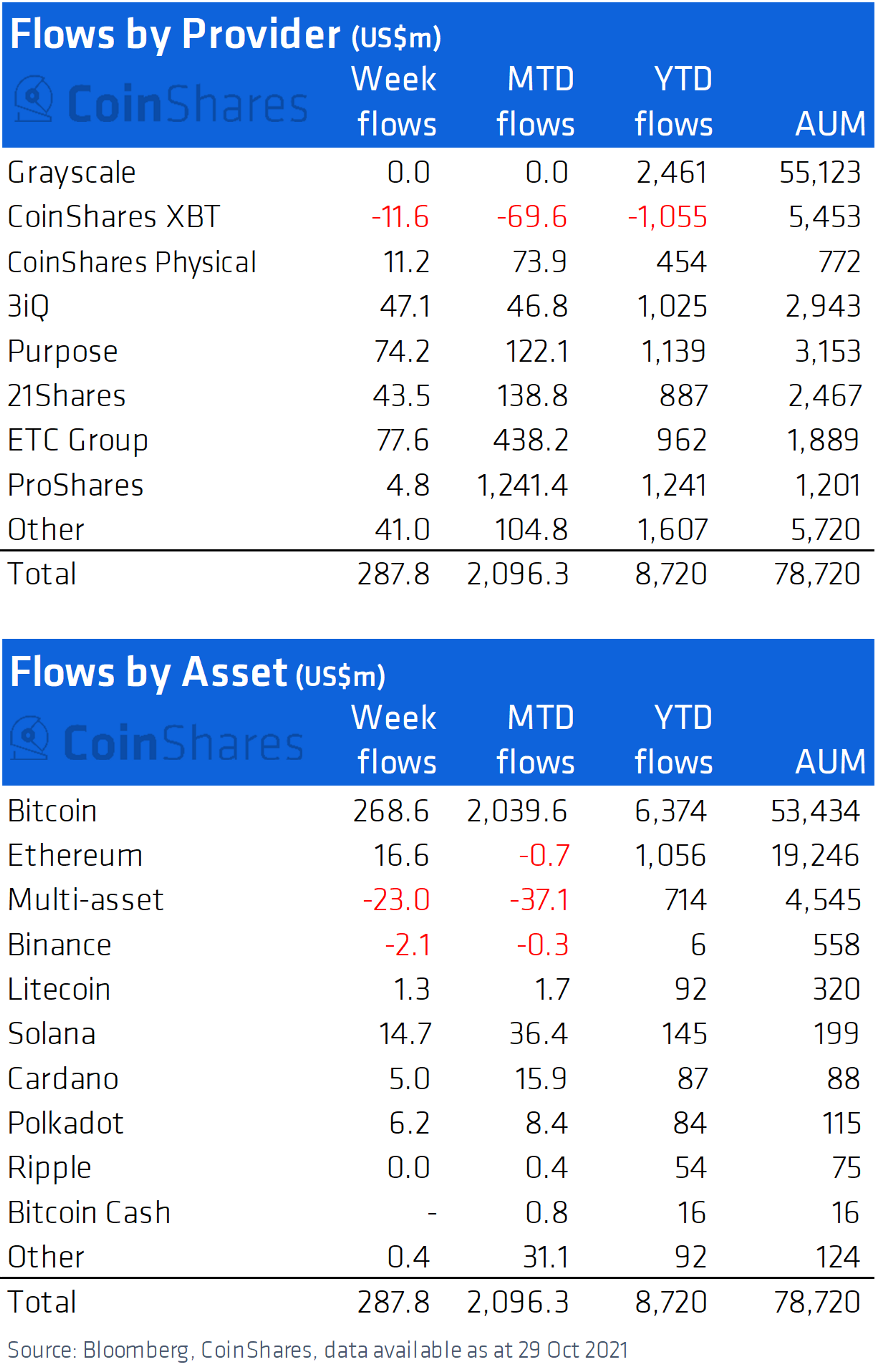

The largest funds provided in the previous week were ETC Group and Purpose with a total of $151 million flowing into the industry. ProShares has only brought in $4.8 million, which indicates that the new futures-backed BTC ETF currently does not fit all institutional investors.

In terms of flows by asset, Bitcoin, as always, saw the majority of inflows at $269 million, which brings month-to-date inflows to $2 billion for October. More than half of the value of the monthly inflows has been reached thanks to ProShares ETF. In addition to U.S.-based companies, ETPs from Canada and Europe also faced funds inflows.

Etherum has finally broken the outflow week, totaling $17 million in inflows last week, with YTD inflows remaining at $1 billion. Thanks to the strong positive performance of the altcoin market, Ethereum's market share has risen back to 32%.

Other altcoins like Solana, Cardano and Polkadot also faced inflows, as well as Ethereum, totaling $26 million. Multi-asset investment products are the only products that faced outflows totaling $23 million. The main reason for this is the popularity of specific products that bring something unique to the market like Polkadot, Bitcoin or Solana.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin