Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

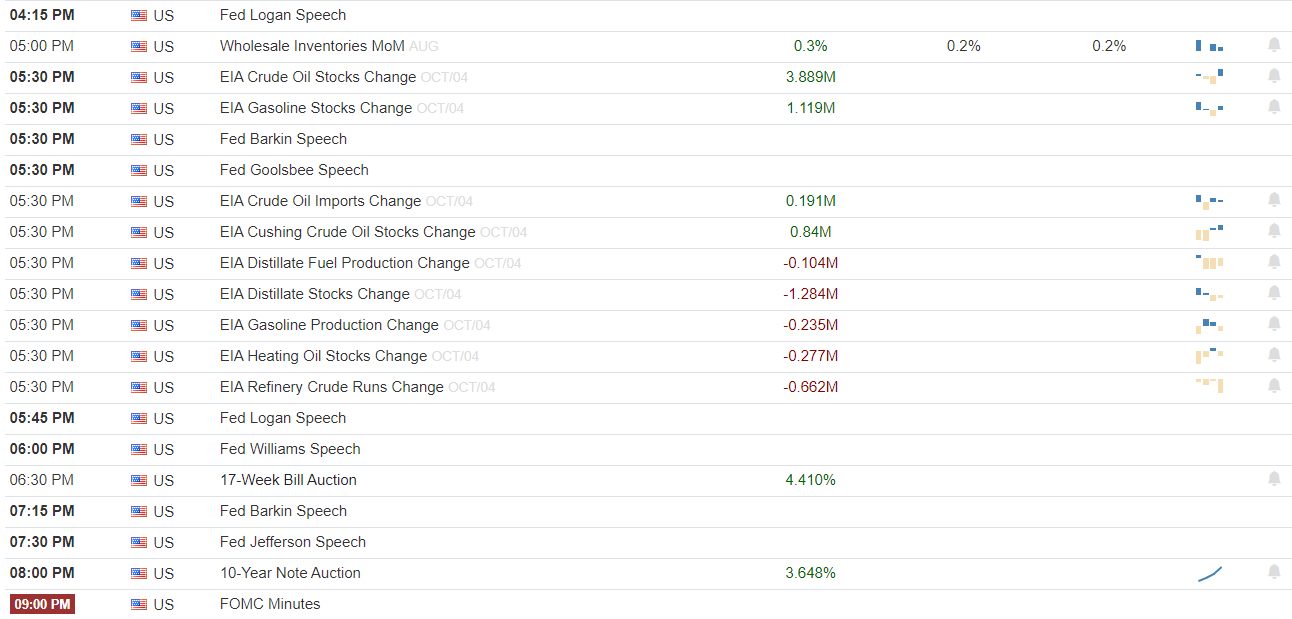

October 9 in particular is predicted to be a turning point for Bitcoin and the cryptocurrency market as a whole this coming week. The minutes of the most recent meeting on monetary policy by the Federal Reserve are scheduled to be released, and significant U.S. Economic indicators that will be released include the Producer Price Index (PPI), the unadjusted Consumer Price Index (CPI) annual rate for September and the quantity of initial jobless claims for the week ending Oct. 5.

The financial markets, including Bitcoin, may become more volatile as a result of these events. Why does Bitcoin care about this? The sensitivity of Bitcoin and other cryptocurrencies to macroeconomic data is growing particularly because investors are using them as a hedge against inflation and currency devaluation.

The Fed's position on interest rate inflation and the state of the economy as a whole will become clear with the release of its minutes. Higher interest rates often cause investors to gravitate toward more conservative assets, so if the minutes show a hawkish tone suggesting more rate hikes, Bitcoin may suffer. When assessing the level of inflation in the U.S., the CPI and PPI data will be essential.

More aggressive tightening measures by the Federal Reserve may follow from a higher-than-expected PPI or CPI, which could indicate persistent inflation. Such acts might increase the volatility of risky assets like Bitcoin. Additionally, initial unemployment claims will provide a glimpse into the U.S. labor market. A more fragile labor market might lead the Fed to reduce its rate hikes, which would be good news for Bitcoin.

Watch out for important levels and potential volatility. Bitcoin's price is probably going to be more volatile because of impending events. Investors should pay special attention to the following key levels: at $63,000, Bitcoin is getting close to a crucial resistance level. The price could move toward the next target of $65,000 if there is a breakout above this level.

Strong support at $60,000 is a critical level of support when things are trending negative. The next support level at $58,000 could be the source of panic selling if this level is broken. Expect Bitcoin to spike in response to any surprises in the Fed minutes or inflation data as Oct. 9 draws near.

Alex Dovbnya

Alex Dovbnya Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin