According to a report published by Canadian analytics firm Nonfungible.com, NFT sales raked in an impressive $17.6 billion in trading volume last year.

NFTs became the talk of the town in 2021, with high-profile sales, celebrity endorsements, incessant mainstream media coverage and major brands like Visa entering the scene.

This speculative frenzy was not without backlash, with a growing community of "right-clickers" mocking people who spend fortunes on JPEGs. NFTs also attracted widespread criticism for allegedly being used for facilitating money laundering and other illegal activities. Some also argue that the prices of NFTs are distorted with the help of wash trading.

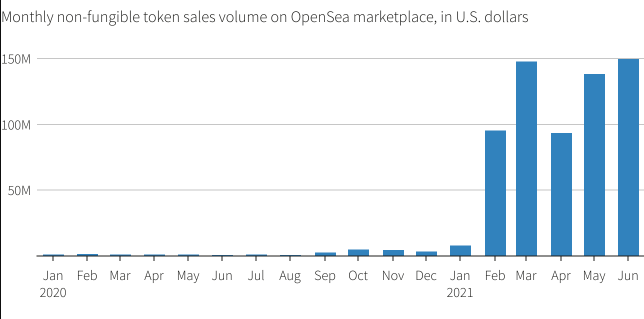

In 2020, for comparison, NFTs were a niche sector, generating a measly $82 million in trading volume.

Their popularity exploded last March when the digital artwork of Mike Winkelmann (aka Beeple) earned $69 million at a Christie's auction, which led to tons of media attention.

Gaming NFTs and digital land gained popularity together with collectibles last year.

Are NFTs losing their mojo?

As reported by U.Today, an ultra-rare NFT from the flagship CryptoPunk collection recently fetched a record-breaking $23.7 million.

Yet the report also notes that NFTs might be losing their luster since there are now visibly fewer buyers on the market. The speculative fervor is likely dying down, which explains why the community is shrinking.

Nonfungible.com does not expect the red-hot sector to experience any significant growth this year.

Yet average trading volumes are holding steady for far, which is why it is safe to assume that NFTs are now going away.

Big-name investors continue piling in. NFT kingpin OpenSea recently reached a valuation of $13.3 billion.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin