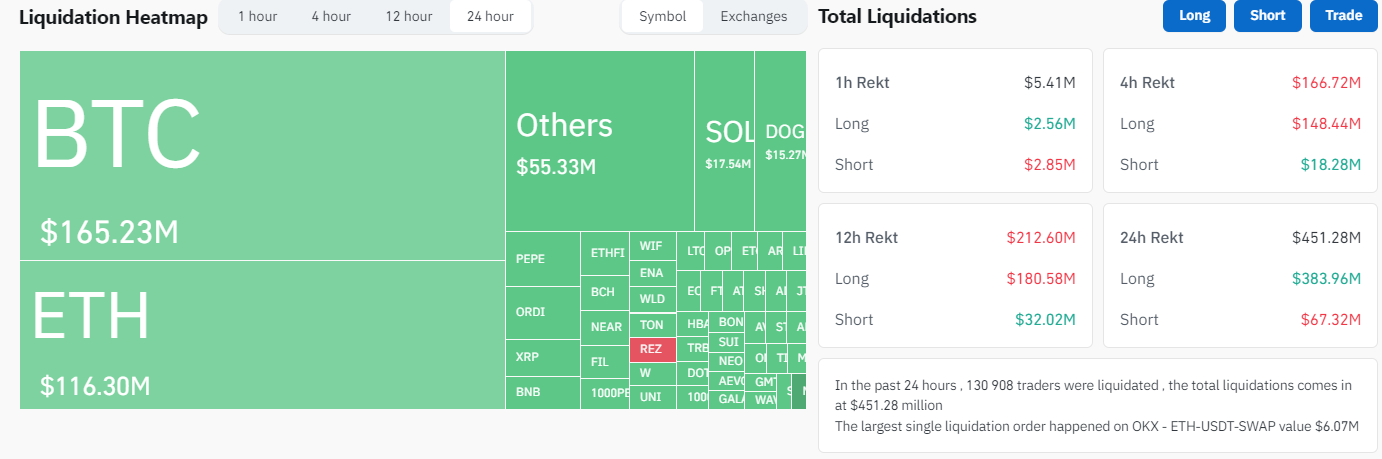

Over $500 million worth of cryptocurrency long positions were liquidated recently, signaling a reversal on the cryptocurrency market. This catastrophic drop, obviously caused by Bitcoin's drop below $60,000, has not only impacted major cryptocurrencies but could cause troubles for smaller tokens.

The Bitcoin chart demonstrates a severe drop below the critical support level of $60,000, cascading down to around $57,000. This massive sell-off triggered widespread panic selling and liquidations. Such extensive liquidations can exacerbate market declines, pushing prices further down as traders rush to close positions, either voluntarily or through forced liquidations.

Interestingly, while long liquidations dominated the structure of the market, the last few hours saw a noticeable increase in short liquidations. As traders awaited further drops and positioned themselves in shorts with some leverage, a slight squeeze occurred. This unexpected shift led to a minor rebound in prices, suggesting a short-term recovery might be possible. However, do not place too much hope in it as it could be purely speculative.

For Bitcoin, the next support level to watch is around $55,000. If this level fails to hold, the next significant support lies near the $52,000 mark. Resistance, on the other hand, can be found at $60,000 and then at $63,000. A break above these levels could signal a potential recovery, but the source for such a move remains unclear.

The current market situation paints a grim picture for the long-term outlook. The high volume of liquidations indicates a lack of confidence among investors, which could discourage the inflow of new capital essential for sustaining higher price levels.

For smaller assets like Shiba Inu, Cardano or even XRP sentiment and investor enthusiasm, the outlook is even darker. The loss of confidence from major cryptocurrency holders can ripple down to these smaller assets, potentially leading to significant declines.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov