Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

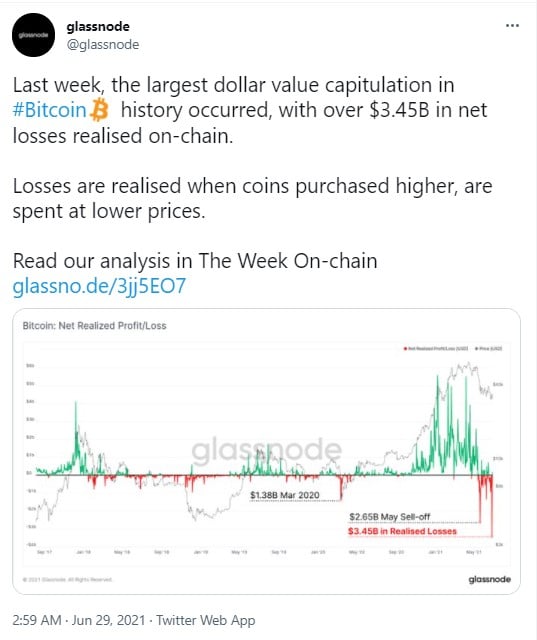

Glassnode's expert team has shared that last week the largest in history Bitcoin capitulation (valued in the USD) took place from short-term holders.

The net losses realized on-chain totaled a staggering $3,45 billion. Glassnode team points out that this Bitcoin was acquired at a higher price level than the one it was sold at.

As for long-term holders, Glassnode shows that they are in profit and have seen only approximately $383 million in net losses.

Right now, 2.44 percent of the circulating Bitcoin supply is stored in the wallets of long-term holders at an unrealized loss, data shared by the Glassnode analytics platform says.

The panic-sell was caused by the plunge of the Bitcoin price below the $30,000 level last week. However, Bitcoin quickly recaptured the $34,000 price line.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov