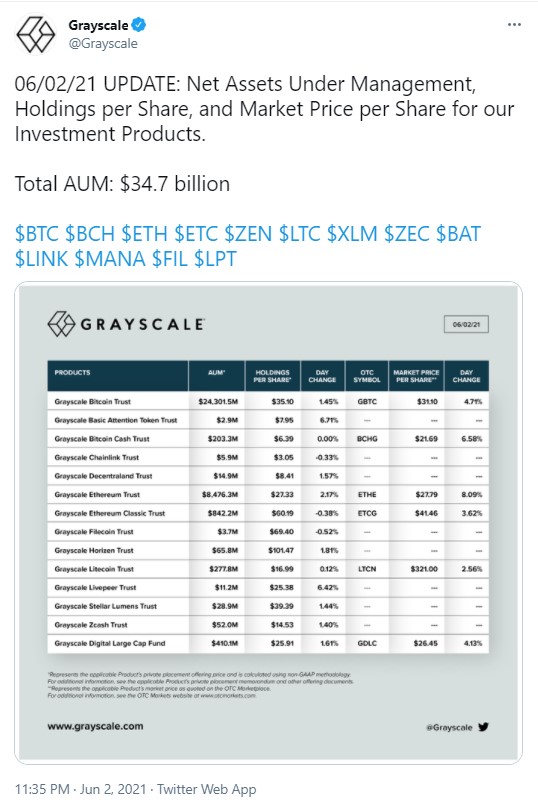

A large buyer of Bitcoin and altcoins, Barry Silbert-affiliated Grayscale Investments, announced that as of June 2, it holds $34.7 billion worth of crypto under management.

That was $0.5 billion larger than the $34.2 AUM reported by the company a day earlier.

Grayscale acquires another $0.5 billion in crypto

On June 2, the Grayscale fund's team took to Twitter to announce that the size of crypto assets they have under management had seen a $0.5 billion increase to $34.7 billion from $34.2 billion.

According to Grayscale's website, the company is currently holding $24,301,467,083 worth of Bitcoin with 692,370,100 outstanding shares; 0.00094219 BTC per one share.

Still, as per its website, Grayscale Bitcoin Trust does not accept private placements at the moment.

Grayscale crypto trusts see massive outflows

According to analytics platform Bybt, investor outflows have been happening for a while already, not only from the Bitcoin Trust but also from trusts based on other cryptos as well.

Over the past 30 days, inflows have been seen only on Litecoin Trust, as well as trusts based on MANA, LPT, LINK, BAT and FIL.

The LINK Trust has also seen inflows of 753 in the past seven days but not Grayscale's other crypto trusts.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin