A chart provided by Glassnode shows that, at the moment, selling pressure on Bitcoin from BTC holders is at its lowest point since November of last year.

Meanwhile, the Bitcoin Stablecoin Supply Ratio has hit an all-time low. Here is why both factors are good for the flagship cryptocurrency.

Bitcoin holders' selling pressure plunges

The CIO of Moskovski Capital has shared a chart from the Glassnode analytics team. It shows that the red selling zone is the smallest since November of last year when green changed to red. Later on, in January, massive sell-offs broke out.

As a reminder, back then on Jan. 10, Bitcoin surged to the $41,000 high for the first time in history.

In November, when the selling had only just started, BTC surpassed the $15,000 level.

As the selling pressure has seen a massive relief since late fall 2020, Lex Moskovski assumes that holders are unwilling to dump their Bitcoin at the current prices and sees this as a bullish sign.

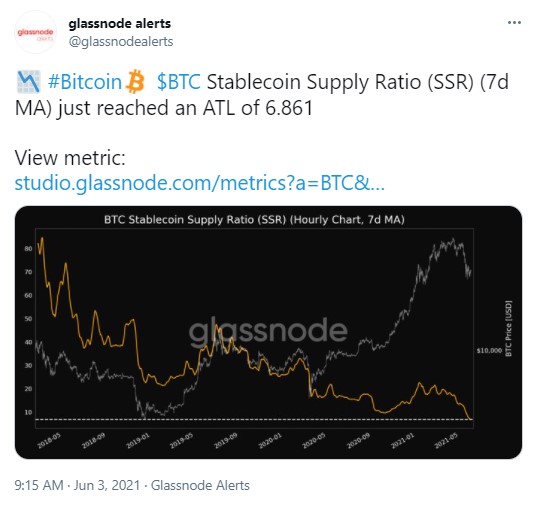

Bitcoin SSR hits an all-time low

Another tweet from Glassnode has announced that the BTC Stablecoin Supply Ratio (SSR) (7-day MA) has dropped to a historic low of 6.861.

This metric shows the purchasing power of stablecoins relative to Bitcoin. If it dives, the present stablecoin supply would have greater purchasing power for the flagship digital currency.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team