Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

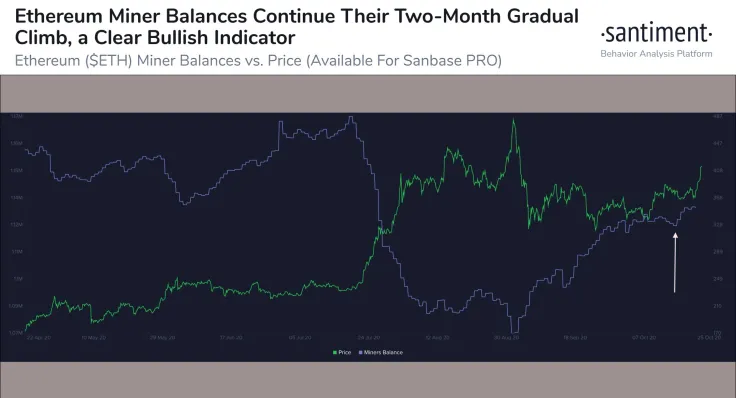

According to the researchers at Santiment, Ethereum miners are not selling and fundamentals are strengthening. The positive fundamental factors are emerging as ETH surpasses $420.

Atop a favorable technical structure after hitting $420, the decentralized finance (DeFi) market is making a comeback.

Lower selling pressure on Ethereum, strong DeFi market activity

Throughout the past two weeks, before its recovery on October 21, Ethereum significantly underperformed against Bitcoin.

In the same period, major alternative cryptocurrencies and DeFi tokens stagnated, struggling to demonstrate momentum.

But after weeks of consolidation, Ethereum is showing decent upward momentum backed by compelling fundamental factors. Santiment researchers said:

“There is good news and bad news for #Ethereum's quest to again surpass the $420 price barrier. The good news is that miners aren't selling, and there is a big increase in new $ETH addresses being created, and pre-existing addresses have shown an increase in activity.”

Advertisement

The medium-term market sentiment on Ethereum remains particularly positive due to the anticipation of ETH 2.0. In 2021, the Ethereum blockchain network is expected to undergo the ETH 2.0 network upgrade.

The upgrade would allow the blockchain to reach higher scaling through a technology called sharding. That would enable Ethereum to process more transactions every second, allowing decentralized applications to operate more seamlessly.

Perhaps due to the excitement around ETH 2.0, Santiment researchers emphasized that the social sentiment around ETH is turning euphoric. Typically, when the market sentiment becomes overly optimistic, the asset is prone to steep correction. They wrote:

“The bad news is that social sentiment is bordering on euphoric territory, and daily active deposits have jumped in a big way.”

Whether daily active deposits would have any significant impact on the price of Ethereum remains unclear. In the last 48 hours, daily deposits rose for Bitcoin and other major cryptocurrencies as well.

The rise in deposits comes after a massive rally of major cryptocurrencies, which is considered normal market behavior.

ETH performance in Q4 2020 is dividing opinion

The perspective on the outlook of Ethereum until the year’s end remains divisive among cryptocurrency analysts.

Cryptocurrency market analyst Ceteris Paribus said he expects Ethereum to underperform based on its recent trend. The analyst said:

“I continue to hold the view that a large $ETH stack is unnecessary in this market. ETH underperformed DeFi significantly and now back to ~0.03 BTC. Sure, ETH will appreciate in bull but app layer just makes more sense to allocate capital. ETH will not challenge BTC as money.”

But analysts who remain optimistic about the trend of Ethereum are pinpointing the total value locked in DeFi. Across all DeFi protocols, there is $12.43 billion locked or deployed, which is an all-time high.

Since most DeFi protocols are based on Ethereum, the rapidly growing DeFi TVL naturally benefits ETH, especially its medium-term prospect.

Denys Serhiichuk

Denys Serhiichuk Tomiwabold Olajide

Tomiwabold Olajide