Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

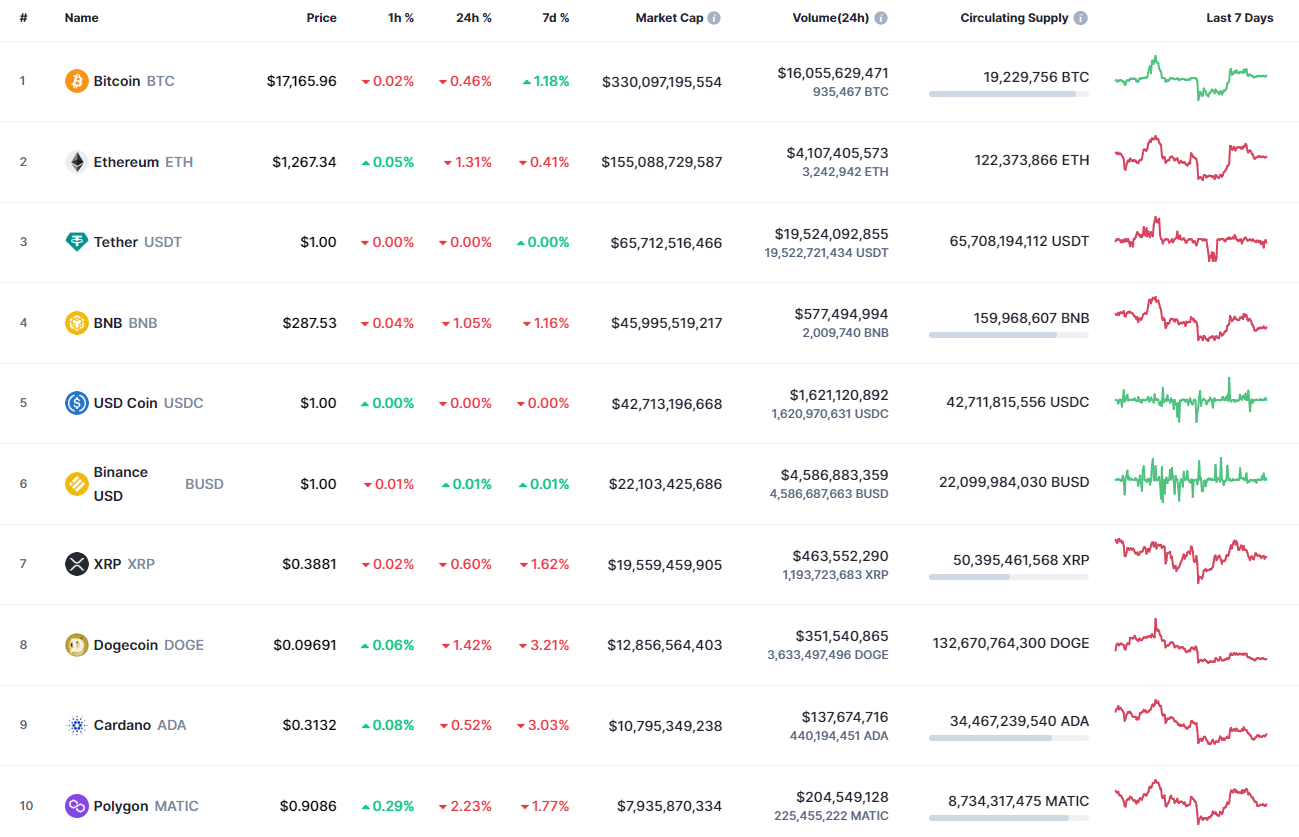

The cryptocurrency market might not have accumulated enough power for a prolonged rise, according to CoinMarketCap data.

ETH/USD

Ethereum (ETH) has lost a lot of value today, falling by 1.31%.

Despite today's fall, Ethereum (ETH) is looking bullish on the hourly time frame, as the rate is located near the resistance at $1,267.60. If buyers can hold the gained initiative, the upward move may continue to the $1,270-$1,275 area soon.

On the bigger chart, the situation is not so clear as the price has not yet decided which way to go against the declining volatility. If buyers want to return to the game, they should bring the price above the crucial $1,300 zone.

On the weekly chart, buyers are trying to get the rate closer to the resistance at $1,291.40. At the moment, one should pay close attention to the closure. If it happens near the $1,290 mark, the next few days might be bullish for the leading altcoin.

Ethereum is trading at $1,268.20 at press time.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov