Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

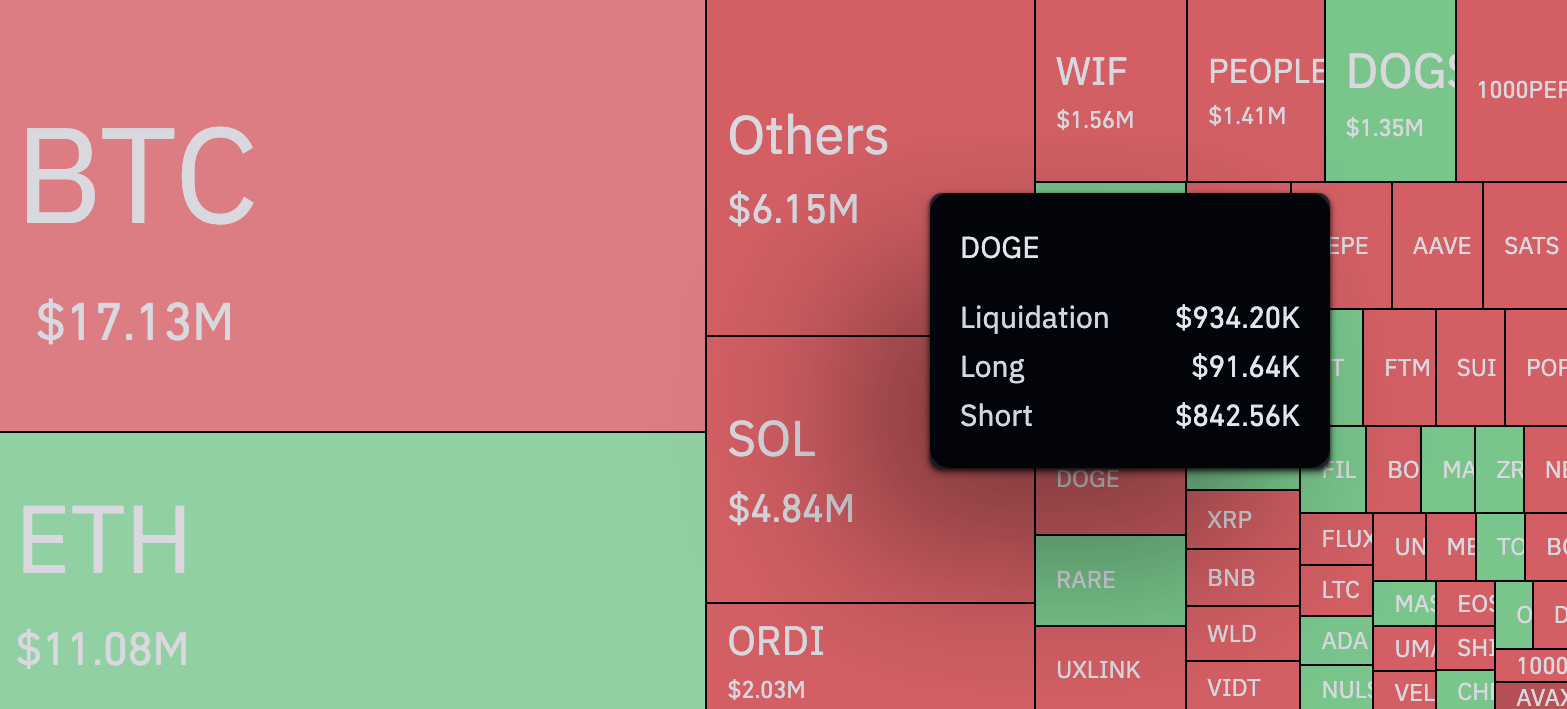

As data from CoinGlass shows, the last 24 hours have been painful for traders who were bearish on Dogecoin (DOGE). Thus, short positions opened with derivatives on the popular meme cryptocurrency took a significant hit, with total liquidations of $842,560.

It does not seem like much in the realm of the crypto market, but compared to the data on long positions, this is hot. For example, during the period under review, liquidations of long positions on DOGE totaled $91,640.

This puts the liquidation imbalance between bulls and bears at a staggering 925%.

Reasons

How is this possible, one might ask. As always, the answer can be found on the Dogecoin price chart. From the 2nd to the 3rd of September, the price of the major meme cryptocurrency soared by over 6%, regaining the $0.10 price mark at the peak of the rise.

Most of this growth came in three hours, when DOGE added 3% in two consecutive hours yesterday, and 1.45% today. As a result, bears, especially latecomers, and those who had bet on the meme coin's fall to $0.0942 were liquidated, thus contributing to the price's upward kickoff.

Interestingly, however, today the price of the meme coin delivered on the bearish side, but only after a crazy 925% imbalance was recorded. Currently, in the last hour and a half, the price of Dogecoin has fallen by 2.91%. Dogecoin is now trading at $0.098 per coin.

In conclusion, we can see that the roller coaster price action is back, but nevertheless, it is the end of a boring market - at least for now.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov