Dogecoin (DOGE), the famous meme-inspired cryptocurrency, is experiencing a surge in large transactions in the last 24 hours, indicating potential activity from major investors, or "whales."

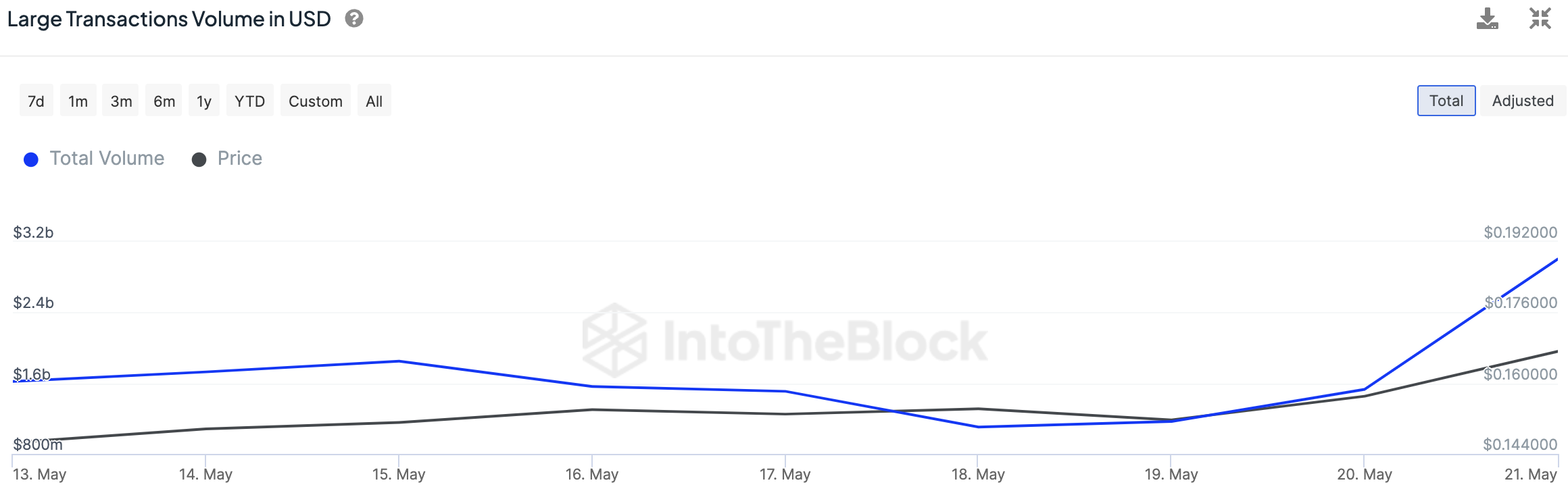

According to data from IntoTheBlock, the total value of these large transactions, exceeding $100,000, nearly doubled in the past 24 hours, jumping from $1.53 billion to a staggering $3.01 billion. This translates to a significant rise in the volume of DOGE being moved by these whales, from 9.74 billion to 17.97 billion coins.

This surge in whale activity coincides with growing speculation about a potential Dogecoin ETF. The recent optimism surrounding the Ethereum ETF has fueled rumors that DOGE could be next in line for its own regulated investment vehicle.

Why is Dogecoin ETF possible?

Dogecoin appears to have several factors working in its favor for ETF approval. Unlike some other cryptocurrencies, DOGE is not suspected of being a security, its futures are already approved by the U.S. Commodity Futures Trading Commission (CFTC) and it boasts a healthy market capitalization of $24 billion, ranking it as the eighth largest cryptocurrency.

Interestingly, Billy Markus, one of the creators behind Dogecoin under the pseudonym Shibetoshi Nakamoto, has even chimed in on the ETF rumor with a lighthearted "amusing" remark.

Whether fueled by these rumors or not, the recent surge in whale transactions suggests heightened interest in DOGE, and investors are watching closely to see if this translates to a price increase.

Gamza Khanzadaev

Gamza Khanzadaev Caroline Amosun

Caroline Amosun Godfrey Benjamin

Godfrey Benjamin Tomiwabold Olajide

Tomiwabold Olajide