Recent comments by a Tether spokesperson have rekindled controversy and speculation surrounding the company's financial activities, particularly concerning its lending practices.

These comments appear to confirm longstanding conspiracy theories about the stablecoin issuer.

Unstable claims

A recent Wall Street Journal piece by Jonathan Weil delves into Tether's latest quarterly financial update, revealing a significant uptick in loans, despite previous assertions from the company that it would curtail such practices. The cryptocurrency issuer reportedly resumed lending its stablecoins, disclosing $5.5 billion in loans as of June 30, up from $5.3 billion the previous quarter.

Alex Welch, identified as a Tether Holdings spokeswoman, confirmed the company's reengagement in lending, marking a shift from its December 2022 announcement that it would phase out its secured loans during 2023. Welch stated that Tether made these loans to "prevent any significant depletion of our customers' liquidity or the need for them to sell their collateral at potentially unfavorable prices," suggesting a protective stance toward its borrowers and the broader crypto ecosystem.

Tether's borrowers, primarily major crypto investors, leverage these loans to secure financing against their crypto collateral, potentially mitigating market impacts, like asset price drops due to forced liquidations.

Tether's retort

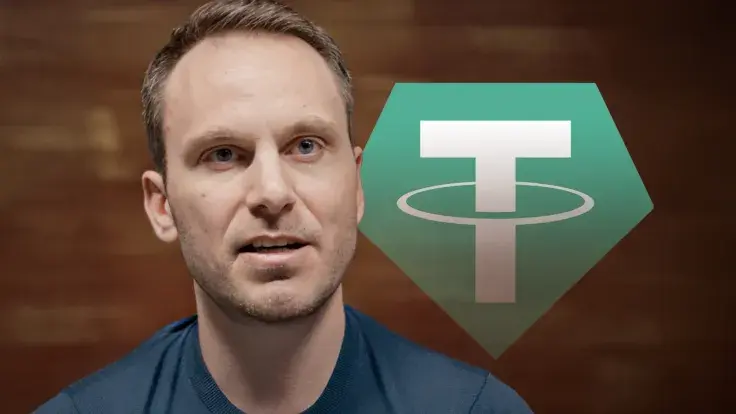

In response to the WSJ article, Tether's CTO, Paolo Ardoino, took to X (formerly Twitter) to refute the claims, stating that the person cited as a spokesperson does not work for Tether and accusing both the WSJ and Bloomberg of propagating unconfirmed information and being biased against the leading stablecoin issuer.

Ardoino emphasized Tether's financial stability, citing excess reserves exceeding $3.3 billion and an on-track profit of $4 billion per year.

He reiterated the company's commitment to reducing exposure to secured loans, contrasting Tether's actions with other entities that, according to him, have not made responsible moves.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov