Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Alarming articles about the “new crypto winter,” i.e., multi-month bear market for Bitcoin (BTC) and major altcoins are popping up here and there. Crypto influencers and media outlets are reiterating that all signs of “winter is coming” are present.

If true, which trading strategy can help holders to come through this painful prolonged correction? And is there a reliable service that can help in implementing such a strategy?

What is a bear market?

A bear market (“winter,” correction, recession) is a market situation in which the prices of the majority of assets are falling. It is accompanied by negative investing sentiment (from “fear” to “extreme fear”) and panic-driven selling.

For stocks and index markets, analysts indicate the start of the bear market at which the rates are falling by 20% from the local peak. As crypto markets are far more volatile, bear markets start here only after a 45-55% decline.

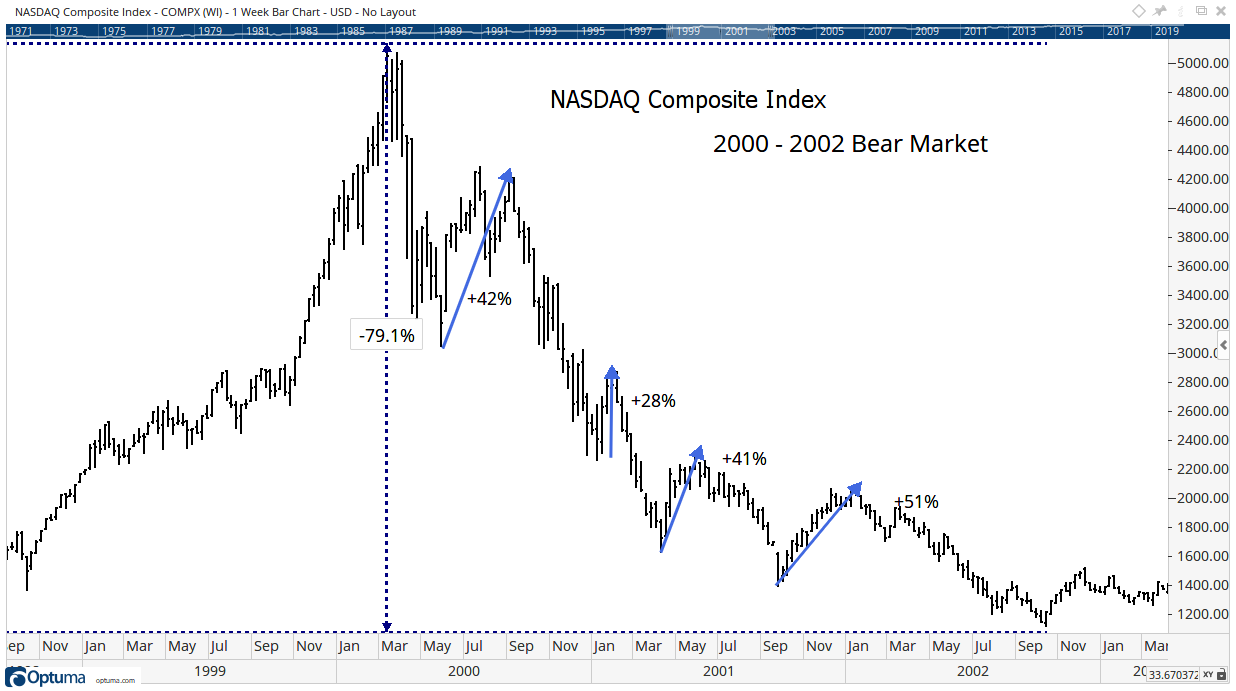

Both traditional and cryptocurrency markets know long-term cycles: every market will go through a bullish and bearish stage. For instance, on Bitcoin (BTC) markets, a bearish recession followed 2013 and 2017 peaks.

For the S&P 500 and Dow Jones Industrial Average (DJIA), the last prolonged bear markets took place in 2007-2009. Similar recessions were registered in March, 2020 but bulls managed to push prices higher.

Is the bear market already in for crypto?

While we cannot be sure about whether crypto markets are already in the “bear market” phase, there are some optimistic and pessimistic theories about this trend.

Bearish: Negative sentiment on social media and euphoria of illiquid NFTs

Mostly, analysts are sure that Bitcoin (BTC) and major altcoins have already dipped into bearish waters. As U.Today covered previously, Santiment statistics show that social media users have not been so bearish since mid-May 2021.

As such, the “crowd wisdom” indicates a bearish correction. So does Chris Burniske, former ARK analyst and author of the most popular crypto asset valuation instruments.

NFT volumes & prices in Jan 2022 have been strong. Many say this shows how everything in crypto may not crash simultaneously again.

— Chris Burniske (@cburniske) January 30, 2022

One could also say #NFTs are at the furthest end of risk, the most illiquid, and so the last to pump with the euphoric gasps of a dying bull. pic.twitter.com/9jW27gwG9s

According to him, the surprising upsurge of the NFTs market is not good for Bitcoin as it siphons liquidity from digital gold and major altcoins. For Mr. Burniske, the entire situation looks like the “ICO boom” that ended with the “crypto winter” of 2018.

Bullish: Healthy on-chain metrics and RSI

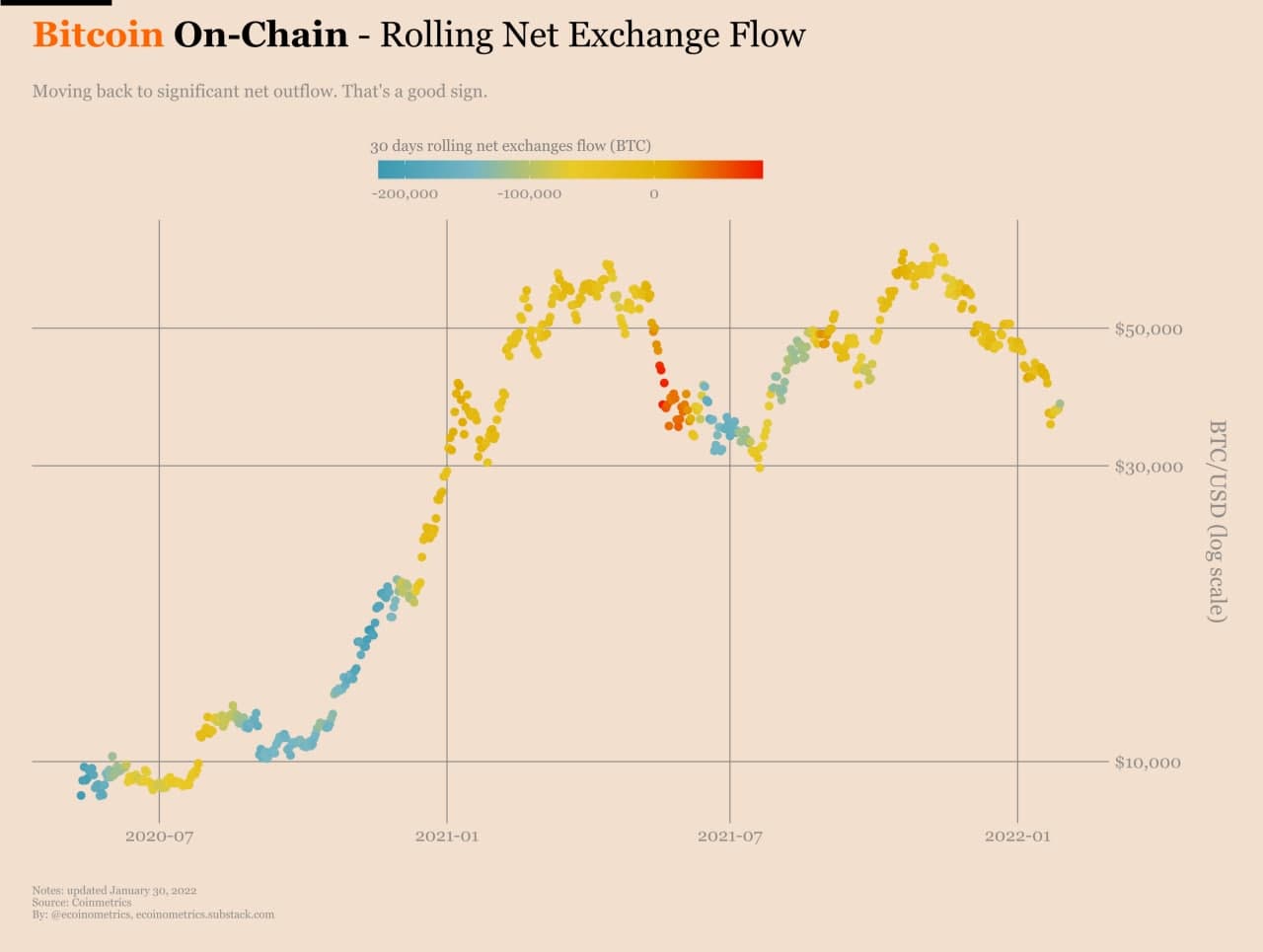

At the same time, the data from many on-chain analytical instruments ‘screams’ that too many large-scale holders are aggressively increasing their bags.

Massive BULLISH divergence between #Bitcoin price and Illiquid supply. HODLers are accelerating their buys.

— Bitcoin Archive ??? (@BTC_Archive) January 31, 2022

Probably nothing... ? pic.twitter.com/EyPaJYjfSU

As per Coinmetrics, Bitcoin (BTC) holders are back to accumulating. So, the sell-off might be over which suggests the upsurge of price is on cards.

Also, Bitcoin Relative Strength Indicator dropped to ‘extremely overbought’ levels unseen since ‘Black Friday 2020 in Crypto’.

Switching to more flexible trading strategy: Psychology and instruments

As the trading sphere has come through dozens of bear markets, there are a number of ready-made strategies that might prove helpful in overcoming a bearish recession with minimum losses.

Stablecoins

Increasing the share of stablecoins in the portfolio might also be a good solution for the bear market. When you are buying stablecoins, you do not need to “cash out” by withdrawing to SEPA, PayPal or other fiat accounts.

With increased stablecoins bags, you will be able to either “buy the dip” in potentially promising assets or try “dollar-cost averaging” (DCA), which is generally considered as the go-to strategy for every bear market.

Diversification: Indexes, stocks, commodities

Last but not least, bear markets rarely target all types of markets simultaneously. So, the diversification of the portfolio should be increased. Bitcoiners can try adding ETFs and real world segment stocks, while “gold bugs” can experiment on ForEx markets.

CFDs on crypto: viable alternative for bear markets

Contracts for difference (CFDs) are contracts that allow traders to find potential benefits in volatility, while for others it might mean higher risks and potential losses as well. As crypto markets are the most volatile ones, trading CFDs here might bring significantly more benefits than that for stocks or commodities, but of course it might also bring losses as well considering the potential risks.

When you are certain that some of your assets have entered the bear market, switching to the strategy with dominant short positions might prove to be a smart move. By opening ‘shorts’ and ‘longs’, traders can benefit from price swings in either direction.

Libertex for crypto and Web3 enthusiasts: Trading with no exchange fees

Various trading options are available with Libertex, a Cyprus-regulated CFD broker for stocks, commodities, cryptocurrencies, ETFs, metals, indexes and ForEx (FX). Its polished UX/UI could potentially unlock some unique opportunities even amid a painful bearish recession.

CFD trading, reinvented: What is Libertex?

Libertex is a regulated trading platform for Contracts for Difference (CFDs). It means that Libertex traders can attempt to take potential advantage of price swings in either direction.

So, what makes Libertex special in 2022?

- 360° regulatory compliance: Libertex is supervised and regulated by CySEC (the Cyprus Securities and Exchange Commission);

- Various types of assets are available: CFDs on cryptos, commodities, indexes, FX positions are available through one dashboard;

- Feature-rich toolkit for experienced traders: MT4 and MT5 interfaces are available as well as its Libertex’s own user-friendly app;

- Multitude of payment methods: SEPA, PayPal, Skrill, Neteller and many more;

- Educational program for beginners and demo account for newly registered users;

- Trading calendar: all crucial events on the stock market are at traders’ fingertips.

Libertex is the official trading partner of Tottenham Hotspur F.C., an English Premier League football club that needs no further introduction.

Advanced trading experience

All positions on Libertex are available through both MT4 and MT5 interfaces as well as through the Libertex mobile app. They boast feature-rich toolkits of indicators, oscillators, time frames and so on. Trading through terminals is available with EUR, GBP, CHF and PLN.

New-gen fee model

To ensure maximum resource-efficiency for all categories of traders, Libertex introduced a completely novel architecture of fees. As of December 2021, all operations in cryptocurrencies CFD trading on Libertex platform are charged with zero commission fees.

Zero exchange fees, commissions or swap fees are introduced for all positions from the crypto segment. As such, spread is the only extra expense for crypto CFD traders.

This scheme is valid for all retail crypto trading clients except for U.K. traders, as CFDs on digital assets are not allowed in this jurisdiction.

Closing thoughts

As the market recession after the 2020-2021 euphoria gains steam, stocks and crypto traders should adjust their strategies to new contexts.

Diversification, a resource-efficient fee model and advanced trading UX/UI is one of the best choices for trading in a bear market.

As such, CySEC-regulated Libertex is quite possibly one of the best go-to solutions for all categories of traders due to its unmatched range of assets available, user-friendly interface, large toolkit of deposits/withdrawals methods and reconsidered fee structure.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Cryptocurrency instruments are not available to retail clients in the UK.

Available for retail clients on the Libertex Trading Platform.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin