Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

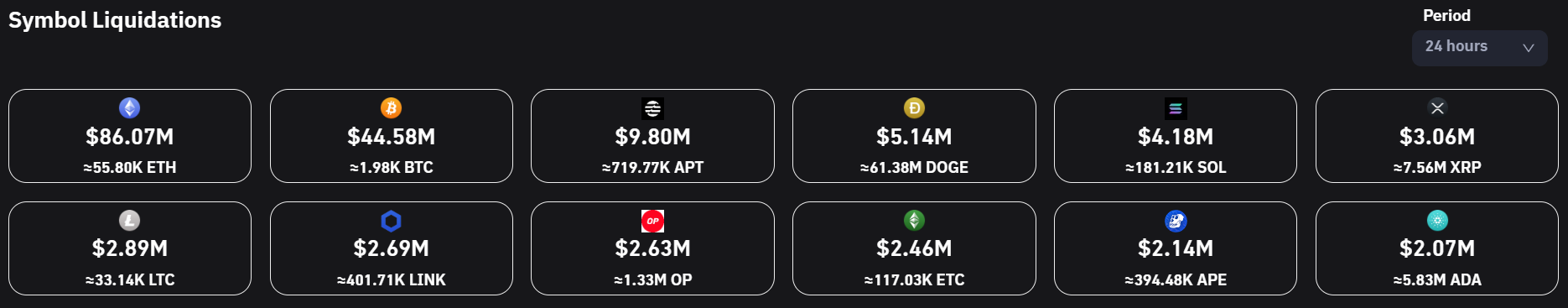

A glance through the crypto market today will show an all-encompassing bearish slump across the board. Besides sensational digital currencies like Threshold (T), the broader ecosystem has recorded a total liquidation worth $223.43 million over the past 24 hours, per data from Coinglass.

The liquidations are not unfounded, seeing as the price of Bitcoin dropped by 1.49% to peg the price of the leading cryptocurrency at $22,554.28. Nonetheless, Ethereum (ETH) recorded the biggest liquidations with approximately 55.74K ETH units worth approximately $86.12 million. Bitcoin's liquidation was pegged at 1.98K BTC units worth approximately $44.59 million.

The liquidations are encompassing and feature some of the high-performance digital currencies that come off as high fliers this year. One of these is the Aptos (APT) coin, a Layer 1 protocol that recorded over 94% growth last week, as reported by U.Today. Per the liquidation data from CoinGlass, Aptos ranks as the third most liquidated coin with over 721.81K APT units worth $9.79 million cleared off the market.

The outlook of the industry shows that the bears are making the effort to erase the valuation boost most cryptocurrencies have recorded since the start of the year.

How are bulls responding?

Liquidations are not an unusual occurrence in the crypto ecosystem, and from observation, market bulls utilize them as springboards to stack up their bags. Riding on the principle that periods of price slumps are the best time to accumulate, we might begin to see intense accumulation at the key resistance points for some of the most liquidated digital currencies.

With BitMEX, Binance, OKX and Huobi arising as the exchanges where most liquidations took place, chances are that market investors will also choose to relaunch their comeback in trades.

Caroline Amosun

Caroline Amosun Tomiwabold Olajide

Tomiwabold Olajide