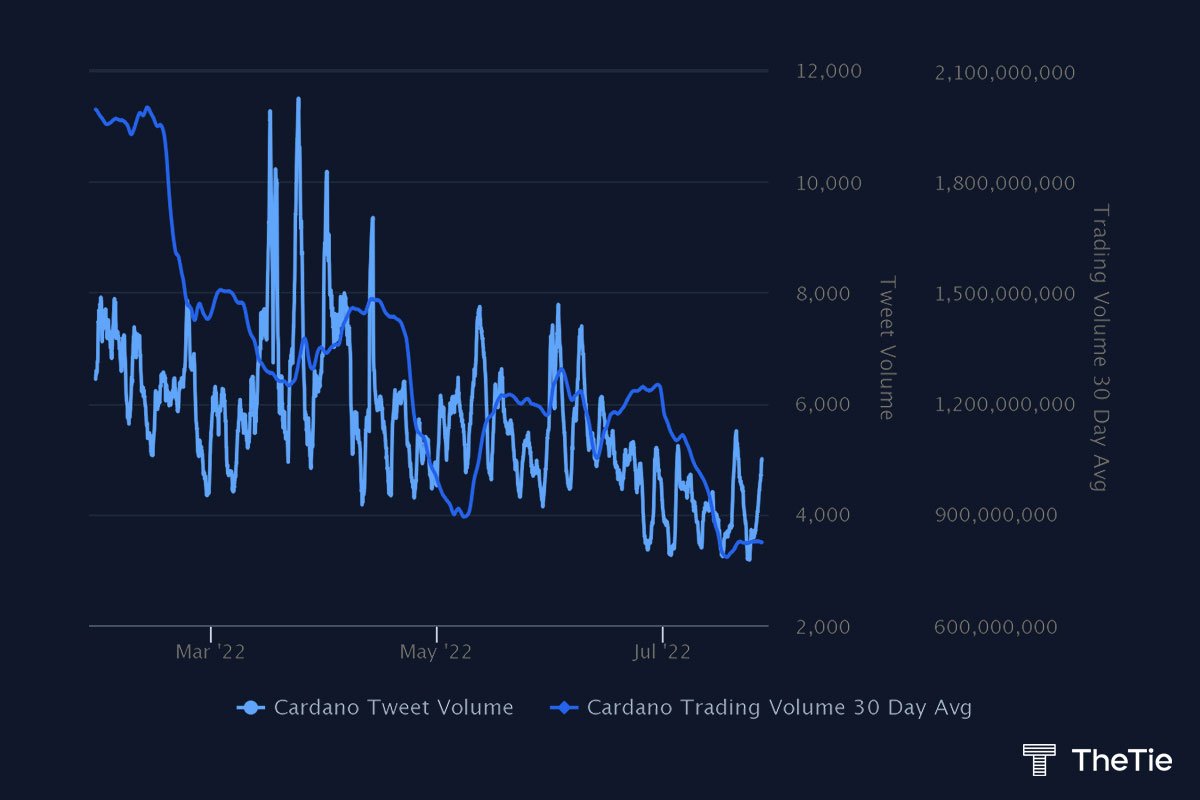

According to data provided by The TIE, a Bloomberg Terminal-esque startup that focuses on information services for digital assets, Cardano’s popularity on Twitter, a popular social media platform, has reached a six-month low.

Notably, this lull in attention also coincided with a sharp decline in trading volumes, which are also sitting at their level in half a year.

With that being said, the ADA price recently experienced a resurgence, adding roughly 10% over the past week alone. As reported by U.Today, the token briefly surpassed Ripple-affiliated XRP by market capitalization on Sunday.

The upcoming Vasil hard fork, which is expected to dramatically improve the network’s efficiency, is the main driver behind the recent price rally.

The upgrade, which was initially set to take place on June 29, has been delayed due to technical difficulties. Cardano developer Input Output is yet to officially announce another launch date, but it was previously mentioned that the rollout of the hard fork would take place during the last week of July.

Despite losing its luster on social media, Cardano continues to see strong developer activity. As reported by U.Today, there’s now more than 1,000 actively developed projects on the network.

ADA remains the seventh biggest token by market capitation, according to CoinMarketCap. It is currently trading at $0.51 on major spot exchanges after adding 2% over the past 24 hours.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin