Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

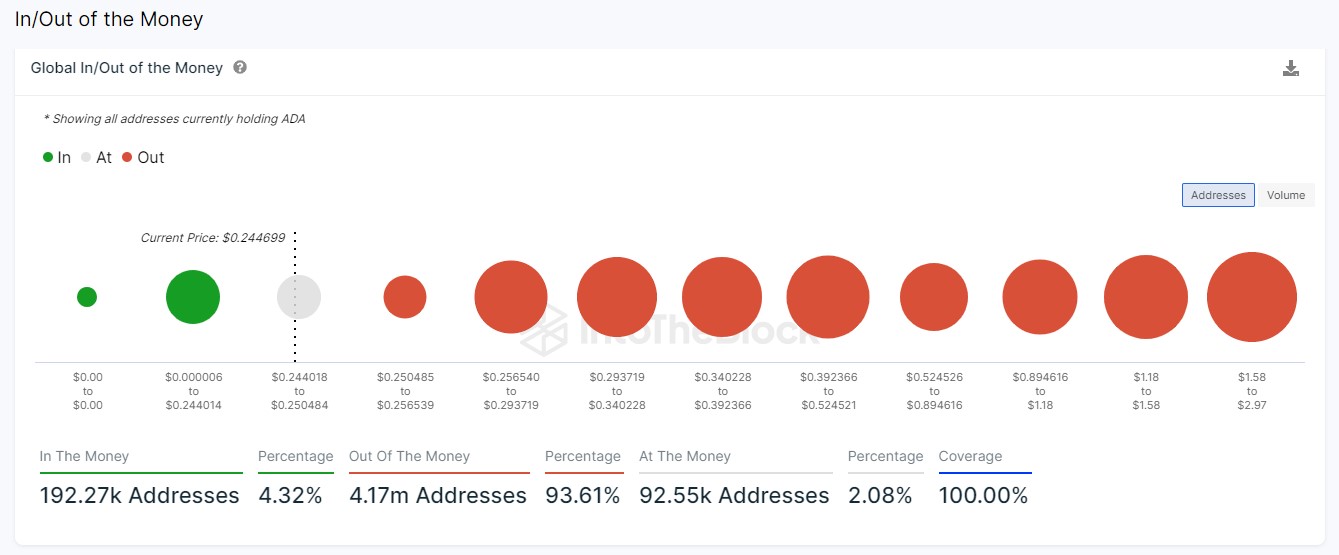

Cardano (ADA) is not living up to the expectations of its investors as the number of addresses that have dipped into losses have hit what appears to be an all-time low (ATL). Data from market analytics platform IntoTheBlock (ITB) showed that the total number of addresses in loss has slumped to 93.61%.

In actual terms, there are currently a total of 192,270 addresses representing just 4.32% of the total wallets registered on the network that have a positive net worth at the moment. The more than 93% addresses in loss are pegged at 4.71 million.

This statistic is notably surprising considering the fact that Cardano is a high-performing blockchain protocol. The recognition of Cardano and its native coin, ADA, is also showcased in its ranking as the eighth largest crypto by market capitalization. This recognition, however, has not translated into profitability for the coin.

This is because its price has been on a downward spiral in recent times, eroding gains that have been accrued over the past few months. At the time of writing, data from CoinMarketCap shows that ADA is changing hands at a price of $0.2451, down by 1.20% in the past 24 hours. Over the past month, the coin has shed as much as 1.38%, with an accelerated drop in its trading volume in that time frame.

Reviving Cardano

At the moment, Cardano is ranked as one of the digital currencies or protocols with very extensive developer activity.

As such, Cardano has proven to have robust fundamentals and developmental activity to set it on the right path for growth in the near future.

The current bearish outlook at this time is a function of the broader market trend and has a strong role to play in helping to chart a steady revival for the digital currency.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin