Renowned analyst Michael van de Poppe (also known as ‘Crypto Michael’) believes that Bitcoin has got itself back on track towards breaking the $10,500 level.

On Monday, Bitcoin printed a temporary low by briefly slipping below $9,000 but then reversed. At the time of writing, BTC is sitting at $9,503.

Bitcoin price targets $10,500

Michael van de Poppe has tweeted that Bitcoin is back in the range and is on track to break $10,500 with the intention of moving towards $12,000.

In his previous video forecast on YouTube, Mr van de Poppe pointed out that Bitcoin would likely reach $9,300 and then return to the $9,000 support.

Holding that support was the main condition for a further rise of Bitcoin towards $12,000, Crypto Michael tweeted.

‘Central banks are doing the leg work’

Travis Kling, founder and CIO of Ikigai Asset Management fund, has reminded the community that holding Bitcoin for profit requires a great amount of patience.

Historically, he said, Bitcoin has transferred wealth from impatient investors to patient ones. He added that, at the moment, banks are doing all of the leg work to facilitate a Bitcoin price surge.

'Older generation of retail investors may beat the new generation with BTC'

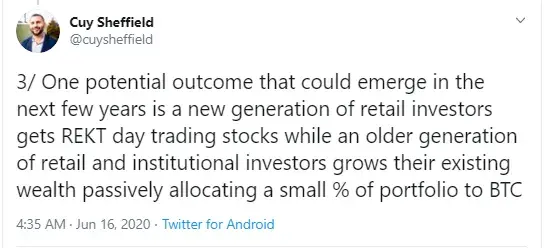

Cuy Sheffield, head of Crypto at Visa, has taken to Twitter to respond to a tweet from the Messari founder about stocks and crypto.

Sheffield wrote that, recently, Bitcoin seems to be losing traction to the stock market among day traders looking to play a market like a casino, hoping to make a quick fortune fast. He also suggested that Bitcoin is gaining traction as a ‘responsible passive, long term investment to DCA’.

Cuy Sheffield also suggested that over the next few years a new generation of retail investors may lose their money trading stocks, while the older generation of retail and institutional investors might increase their passive income by investing a small percentage of their funds in Bitcoin.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin