Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

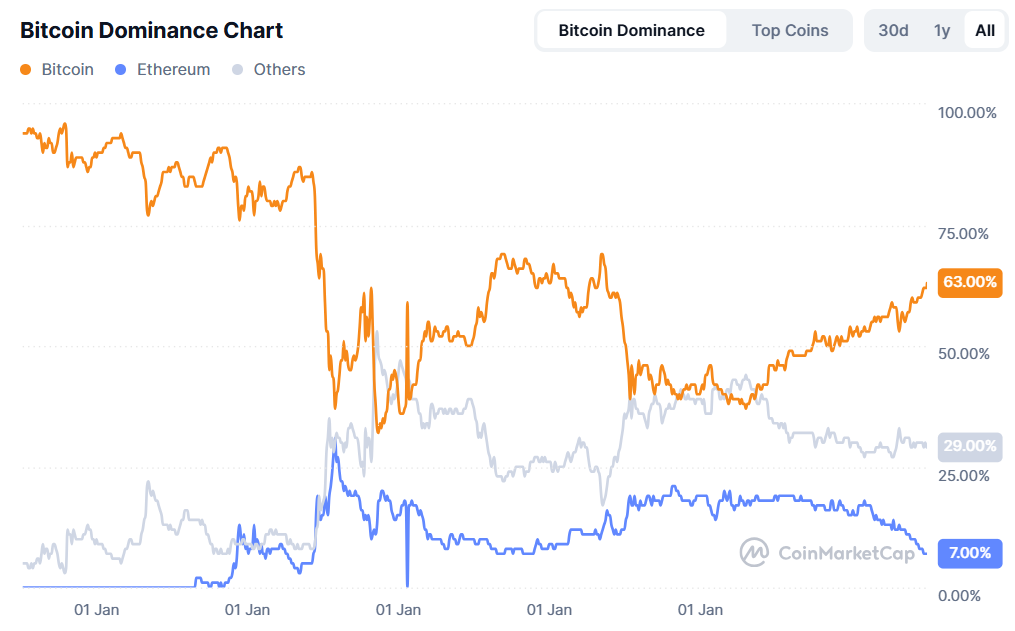

Bitcoin (BTC), the world’s leading digital currency, is showing promise as it has regained dominance in the cryptocurrency space. According to CoinMarketCap data, Bitcoin Dominance (BTC.D) has hit 63.5% after its price skyrocketed by 3%.

Bitcoin reclaims market share as altcoins retreat

For clarity, BTC.D refers to the percentage of the total crypto market capitalization that comprises Bitcoin. This recent rise signals that Bitcoin has rebounded and is dominating the crypto market's list of assets.

Notably, despite being a leading asset, Bitcoin has not reached the 60+% level since March 3, 2021, when it reached 60.3%. Interestingly, BTC.D is ascending and could climb to between 66% and 70% before the end of the next quarter.

This resurgence after a long 48-month period suggests that Bitcoin’s price might record a significant uptick in the coming days, despite reservations about the current bull rally.

As of press time, Bitcoin is changing hands at $90,250, following a 3.26% increase in its price. Investors have also shown significant interest, as trading volume jumped by 35.68% to $36.87 billion.

Bitcoin is currently 18.58% away from its previous all-time high (ATH) of $109,114.88, which it achieved in January 2025.

The current development is likely to support BTC's breach of the psychological $100,000 level. If momentum is sustained, the asset could push toward a new ATH, as some projects predict BTC will reach $150,000 before the end of 2025.

Meanwhile, Ethereum’s dominance has dropped by 1.63% to 7.1%. The remaining altcoins stand at 29.4%.

Bitcoin builds momentum amid investor confidence

The resurgence in Bitcoin Dominance might have triggered investors to pivot to digital assets after U.S. tariff concerns. Despite the 90-day pause, the global market still remains on the edge.

This dilemma might see investors shifting from traditional assets like bonds to crypto, with Bitcoin a clear favorite.

In the last 24 hours, Bitcoin’s open interest has registered a 7.09% uptick as investors commit to the asset’s future. A total of 710,620 BTC, valued at $63.73 billion, have been committed to Bitcoin’s future price action.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov