Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The longer Bitcoin (BTC) keeps quoting at elevated prices, the more damage it brings, or at least that is the perspective Peter Schiff stands by, making it clear that every dip, every moment of market correction, is one step closer to what he sees as the inevitable collapse of a financial illusion. For him, the fall is not just coming; it is necessary. If that means some investors get caught on the wrong side of trading, so be it.

This latest statement came after Schiff was confronted online by a user who accused him of “kicking down” Bitcoin holders when the market turns red.

Schiff, never one to soften his stance, responded that his criticism is not about individuals losing money but about exposing what he believes is a prolonged bubble that keeps pulling more people into financial risk.

The way he sees it, Bitcoin is not just a speculative asset, it ia a dangerous one, and the "burst of this bubble" is not a matter of if, but when.

His renewed attacks on Bitcoin come at a time when he is already in the middle of another financial battle, this one much more personal. His Panama-based Euro Pacific Bank, which faced regulatory scrutiny and was ultimately shut down, remains a key point.

Issues

Schiff says the U.S. Internal Revenue Service played a major role in its downfall, saying the bank's closure was politically motivated rather than based on real legal issues. Whether his claim is true or not, it adds to the frustration of his ongoing financial story.

Meanwhile, Bitcoin itself is not exactly showing strength. After failing to hold above its 200-day moving average on the daily chart, it saw a sharp price reversal, dropping over 2% in just four hours and hitting a low of $82,300 per BTC.

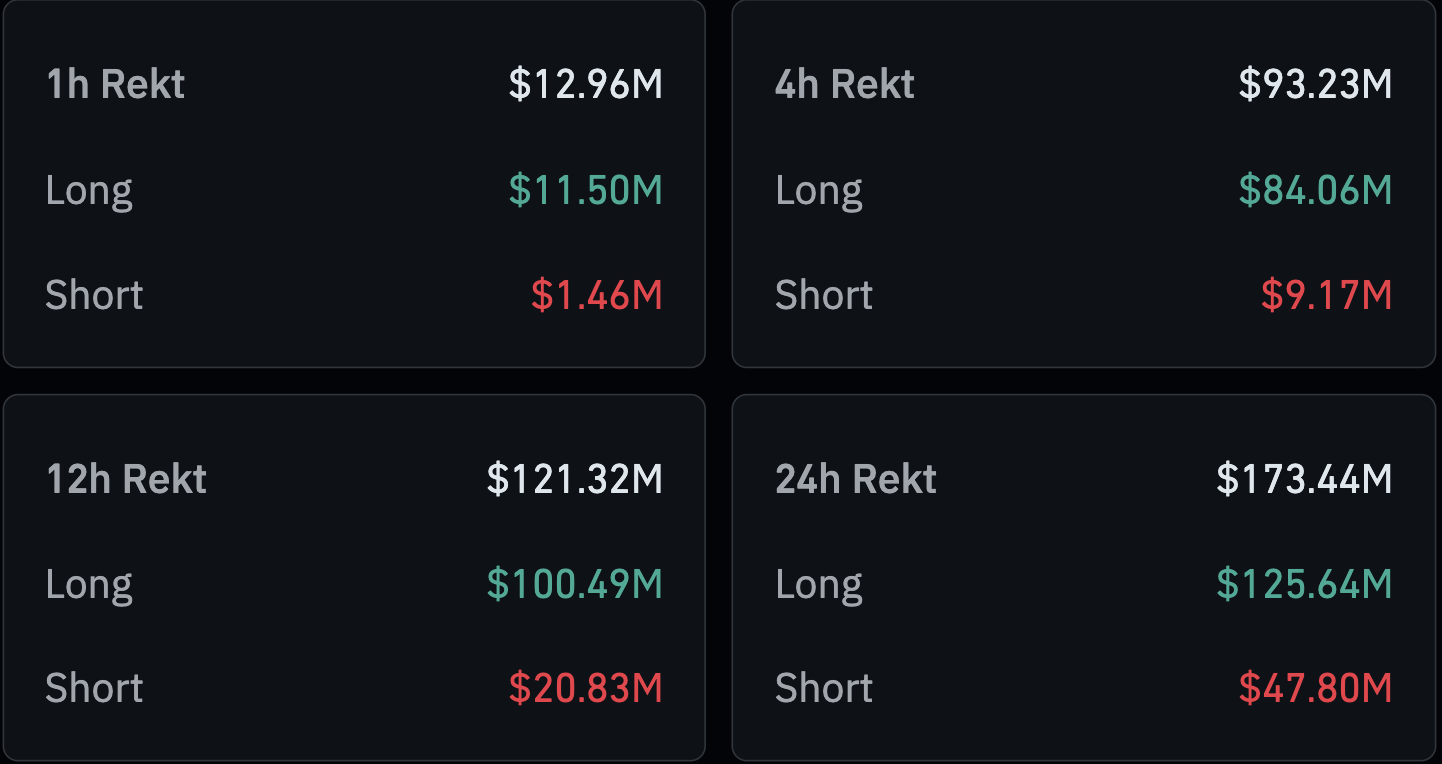

This caused a wave of liquidations across the crypto market, leading to a total wipeout of positions worth $93.2 million. The majority of this, $83.98 million, came from long positions. For those who had been counting on the price to keep rising, this was a tough move.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov