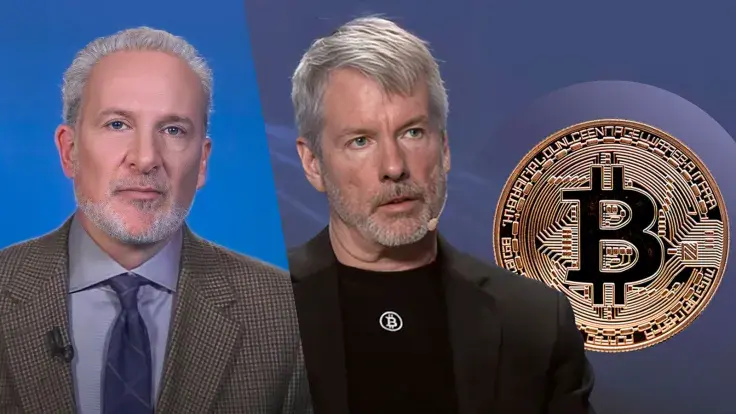

Gold bug Peter Schiff recently took aim at Bitcoin evangelist Michael Saylor over his recent announcement of a $500 million bond sale that is meant to boost Bitcoin.

Schiff predicted that the price of the flagship cryptocurrency could crash if Saylor were to stop propping it up with massive leveraged buying. "Not again. I wonder how much lower Bitcoin would be now were it not for all this leveraged buying," the cryptocurrency critic said.

The 61-year-old financial commentator further suggested that creditors could "finally force" Saylor to liquidate its Bitcoin holdings.

After initially adopting the flagship cryptocurrency as its treasury reserve asset in August 2020, MicroStrategy went on to announce its first convertible bond offering in December 2020 to specifically buy more Bitcoin. The move spooked some analysts, with Citi rushing to downgrade MicroStrategy's stock.

The latest offering is also supposed to boost the Bitcoin fortune of the Nasdaq-listed company.

It is worth noting that MicroStrategy already owns a whopping 214,000 coins, whose cost basis stands at $7.5 billion.

While Schiff is known for his doom-laden Bitcoin takes, banking giant JPMorgan also expressed concerns about MicroStrategy's leveraged Bitcoin buys earlier this year. JPMorgan's Nikolaos Panigirtzoglou believes that there is a risk of "severe deleveraging." Such a scenario could occur if crypto prices were to drop substantially lower. Hence, Schiff's criticism is clearly not unfounded.

Earlier this week, Schiff also cautioned Bitcoin buyers that ETFs would not save them since their buyers are not "diamond hands" holders.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov