Today, on April 20, 2022, the Bitcoin (BTC) price managed to bounce back above $42,000. At the same time, digital gold still has room for growth, Willy Woo's Highly Liquid Supply Shock indicator says.

What supply shocks can say about Bitcoin (BTC) price

Top-tier Bitcoin (BTC) researcher and analyst Willy Woo has taken to Twitter to share bullish forecast on mid-term price dynamics for digital gold.

Orange coin seems a bit undervalued here.

— Willy Woo (@woonomic) April 20, 2022

Not a bad time for investors to wait for the law of mean reversion to play out. pic.twitter.com/7NDA3P1RKx

Such a statement was made based on the Highly Liquid Supply Shock indicator, which is a version of Mr. Woo's Supply Shock metric. Supply shock is the ratio between unavailable supply and available supply of this or that asset.

Regarding Bitcoin (BTC), Mr. Woo describes the Highly Liquid Supply Shock indicator as the ratio between the number of coins held by long-term holders and short-term speculators.

Historically, the Bitcoin (BTC) price shows a strong correlation with Supply Shock indicator dynamics, Mr. Woo adds:

At first glance you can see the Supply Shock model tracks price quite closely. A closer look shows Supply Shock leads price.

Advertisement

Psychologically, Bitcoin (BTC) Supply Shock indicators demonstrate the sentiment of investors: once coins are bought/sold, they migrate from the "illiquid supply" to a "liquid" one.

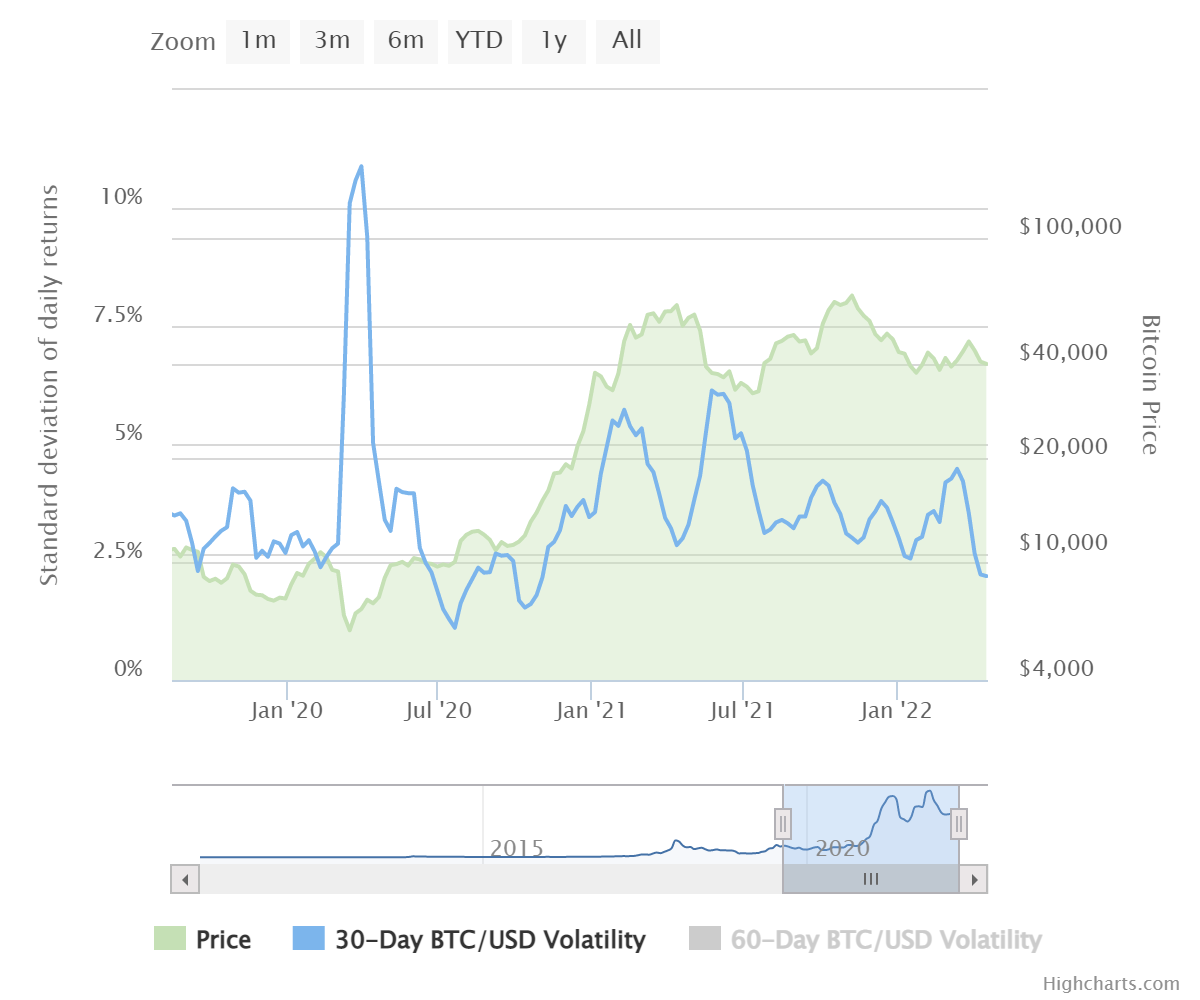

Bitcoin (BTC) volatility targets 17-month lows

Such a promising price action is accompanied with the record-breaking dropdown of Bitcoin (BTC) volatility.

The standard deviation of daily returns (i.e., how much Bitcoin adds or loses in 24 hours) dropped below 2.5% on the 30-day average chart for the first time since mid-November 2020.

The last time that Bitcoin 30-day price volatility was at today's lows, the orange coin was worth $11,000.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov