Bitcoin has been holding above the crucial $10,000 support for 100 days now, setting a record. It has also broken above the $14,000 level twice since 2018 over the past few days.

Bitcoin holding up for over 3 months, breaching $14,000 twice

Bitcoin first broke above the $10,000 level on July 26. Since then, it has been holding above that mark and rising.

The period from July 26 to Nov. 4 makes up 100 days.

Twice recently, since early 2018, Bitcoin has broken above the $14,000 resistance. This occurred on Oct. 31 and Nov. 3: on Halloween and on the 12th anniversary of the the Bitcoin white paper release.

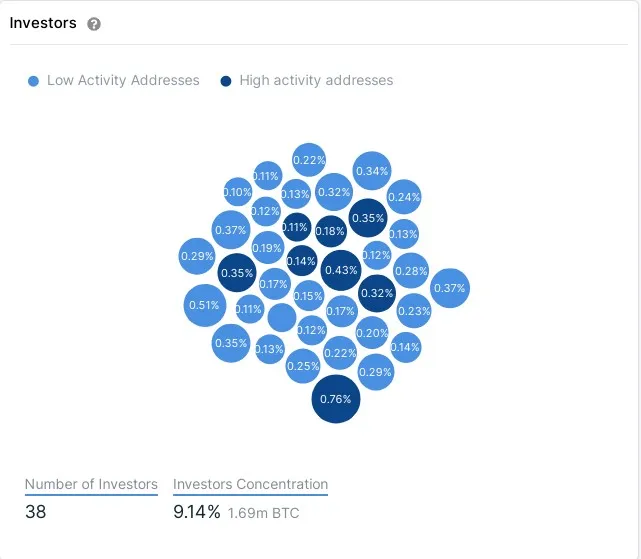

Institutional players' interest in BTC surges

Interest from financial institutions has been on the rise lately and is believed to be the major catalyst of the Bitcoin growth, as well as its record of holding above the $10,000 level for over three months.

As a reminder, such market giants as Nasdaq-traded Microstrategy obtained $425 mln worth of Bitcoin recently—on which they have now made larger profits than their revenue from business operations—and Square, spearheaded by Twitter CEO Jack Dorsey, acquired Bitcoin, allocating $50 mln to it.

Is Bitcoin yielding to miners' cashing out?

At press time, Bitcoin is trading at the $13,649 mark, according to data from the CoinMarketCap aggregator. On November 3, Bitcoin was briefly pushed above the $14,000 mark.

At this high price level, Bitcoin miners' outflow and amount of exchange deposits surged, as per Glassnode statistics.

The current value of BTC exchange deposits (2d MA) now totals 1,270.333 (up 18.7 percent in the past 24 hours). As for Bitcoin miners' outflow, it is up 40.3 percent and totals $939,649.07.

The amount of active BTC addresses has not increased, according to data from Intotheblock, as retail holders are unwilling to part with their BTC.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin