Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

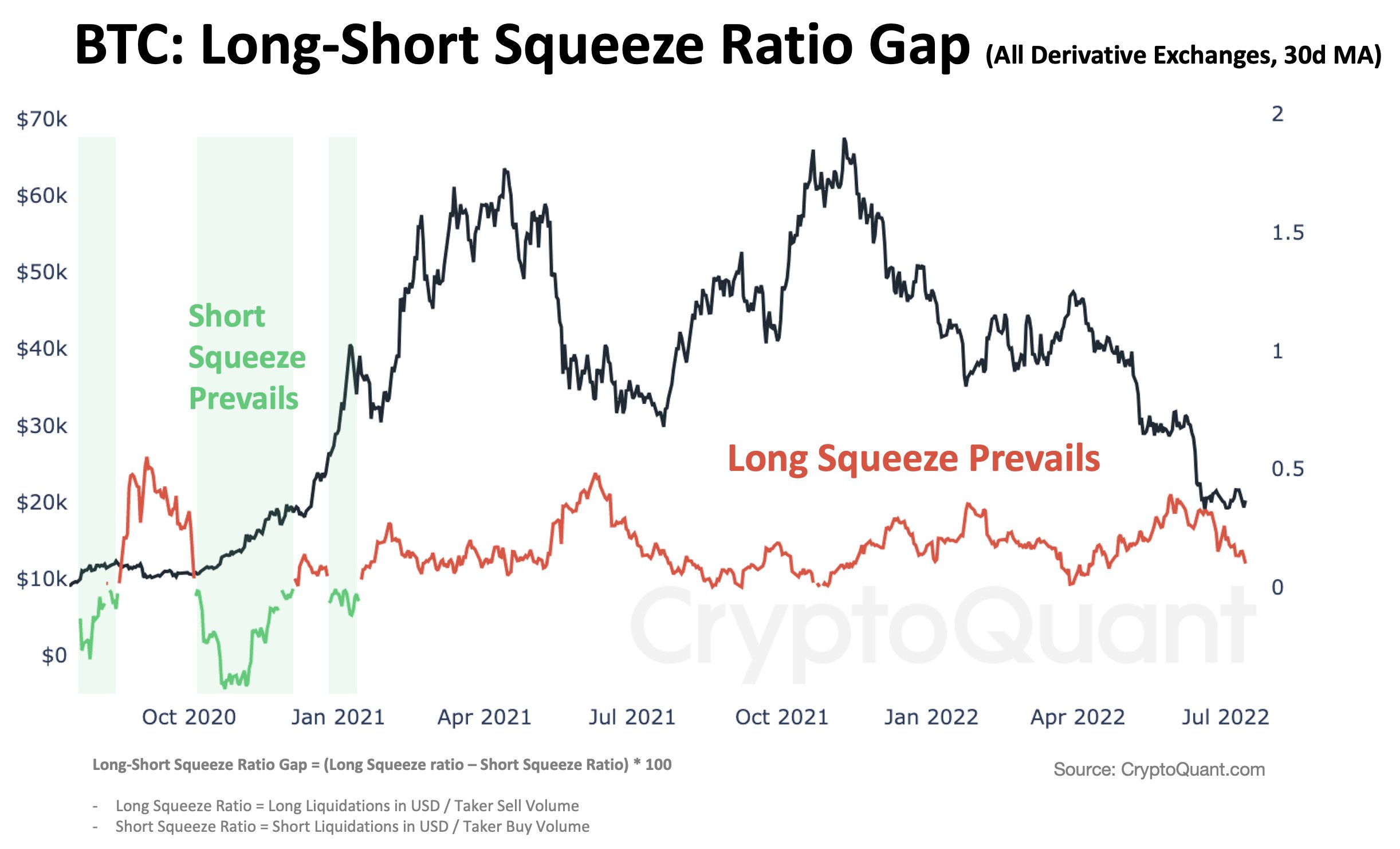

Ki Young Ju, CEO of South Korea-based on-chain analytics company CryptoQuant, has predicted that Bitcoin could soon see a massive short squeeze.

He notes that many traders kept accumulating short positions in late 2020 in the $10,000-$20,000 only to be wiped out later.

Short liquidations accounted for roughly 10% of hourly buy market orders, according to June. Such a scenario could play out now, giving Bitcoin a short in the arm.

Don’t get too excited

The fact that Bitcoin could potentially experience another significant short squeeze doesn’t mean that a new bullish cycle is about to start, according to Ju.

However, it does indicate that the cryptocurrency is close to bottoming out. Last month, Bitcoin dipped to as low as $17,600 before seeing a mild relief rally.

It could take “a few months or years” for another parabolic bull run to start. Brandt predicted that the next Bitcoin “rocket stage” would be ignited in 2024.

Bitcoin remains in limbo

On July 13, the largest cryptocurrency managed to reclaim the $20,000 level, but market sentiment remains overwhelmingly bearish.

The “Fear and Greed Index” remains in the “extreme fear” territory, according to the most recent update.

A recent Bloomberg survey showed that most retail and institutional investors expected the largest cryptocurrency to plunge to as low as $10,000.

Some analysts believe that the Fed’s increasingly hawkish monetary policy. The central bank is now highly likely to announce a 100-basis point hike after the most recent inflation data.

The top cryptocurrency is currently trading at $20,538 on the Binance exchange.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov