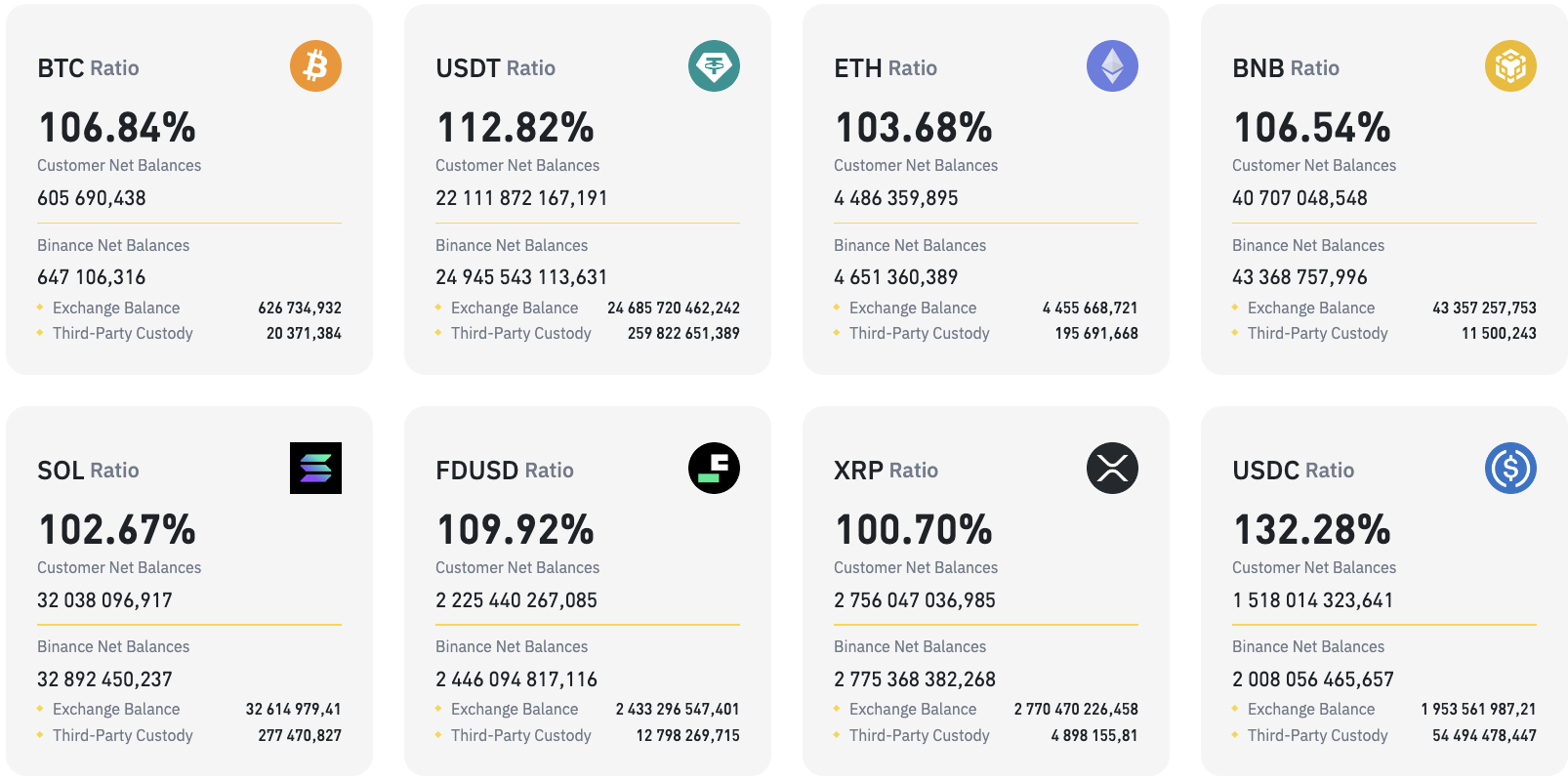

The world's largest crypto exchange, Binance, has released its latest proof-of-reserves report, and it contains some interesting and unexpected data. According to the 22nd monthly report with a snapshot of Sept. 1, the Bitcoin assets of Binance users are 605,000, down 1.27%, and Ethereum assets are 4.486 million, down 4.58% from the last time, a decrease of 215,000 ETH.

Meanwhile, the user's USDT assets are 22.11 billion, up 4.34% from the last time, an increase of 919 million USDT.

As we can see, the trend with major cryptocurrencies and Binance users is that the holdings in them are decreasing, while stablecoins are increasing. This may be due to the fact that users are cashing out and selling their cryptocurrency for USDT and other options such as FDUSD. Holdings of the latter increased even more - up to 2.23 million coins, which is 59.2% higher than the previous month.

This trend did not leave XRP untouched. Thus, users holding the seventh largest cryptocurrency decreased to 2.75 billion XRP, which is 174.89 million coins less than in August. Binance still offers 100.7% coverage for all user assets on its platform and itself holds 2.77 million XRP. Last month, however, it was by even more - by 6.4%.

Still bullish?

If we are trying to find a silver lining here, or even a blessing in disguise, it is the fact that users are opting for "crypto cash" rather than traditional fiat. They are exchanging their BTC and altcoin holdings for stablecoins, staying in the market but somewhat on the sidelines.

Perhaps, when the conjecture becomes more clear, this ton of digital money will flow back into assets like XRP, creating a new wave of growth for the cryptocurrency market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov