In any financial market, traders should have a metric of performance to evaluate their trading results. The cryptocurrency market is highly volatile but the need to evaluate and measure performance is also both useful and practical for professional traders, institutional trading desks and sole traders.

Having a portfolio of cryptocurrencies measured against a valid benchmark and index provides both analysis of the excess alpha and a documented track record of investing. This can help to analyze scenarios about the investing strategy chosen, the risk management, the profitability, and provide very important feedback for portfolio managers and professional investors.

For benchmarks to be valid they need to exhibit the following characteristics:

1. Unambiguous. The identities and weights of securities or factor exposures constituting the benchmark are clearly defined.

2. Investable. It is possible to forgo active management and simply hold the benchmark. That is, investors can effectively purchase all securities in the benchmark.

3. Measurable. The benchmark return is readily calculable on a reasonably frequent basis. A good benchmark will have a transparent set of public rules and, therefore, predictability for investment managers.

4. Appropriate. The benchmark is consistent with the manager’s investment style or area of expertise.

5. Reflective of current investment opinions. The manager has current investment knowledge (be it positive, negative, or neutral) of the securities or factor exposures within the benchmark.

6. Specified in advance. The benchmark is specified prior to the start of an evaluation period and its calculation methodology is known to all interested parties.

7. Owned. The investment manager should be aware of the strengths and weaknesses of any benchmark they are asked to replicate or be judged against. It must also accept accountability for a client’s portfolio performance against that benchmark and be ready to explain to the client any variance from the benchmark. Consideration of the benchmark should be embedded in and integral to the investment process and portfolio construction conducted by the investment manager.

A high-quality benchmark or index should have the following characteristics:

1. Free of conflicts of interest

2. Provide independent review/pricing; and

3. Have transparent methodology

The regulatory authorities can place a lot of emphasis on the following topics:

· Ensuring benchmark administrators are free of conflicts of interest and that they employ relevant governance and controls

· Ensuring that the data used to calculate benchmarks are enough and that the calculation methodologies are robust

· Ensuring that any contributors to benchmarks have adequate controls and avoid conflicts of interests.

There are several benchmarks and indexes in the cryptocurrency market. We will refer to three of them as a starting point for performance evaluation:

· The Bletchley Indexes

· CME Group Indexes

· The CCi30 index, https://cci30.com/?from=article-links

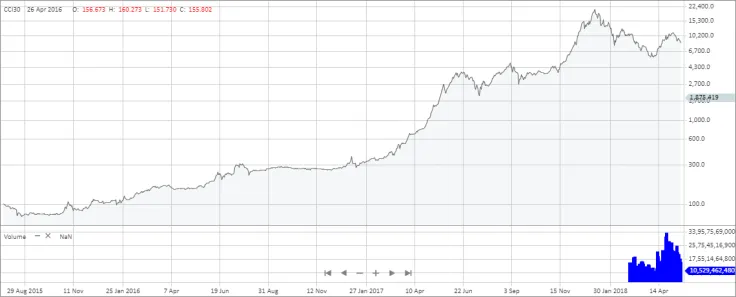

The above chart is the daily chart for the CCi30 index. As of Dec. 13, 2018, the index in real time is at 1,839.83, -35.59, -1.93%. CME Group Indexes are the most standardized reference rates and spot price indexes, and as mentioned “CME Group and Crypto Facilities created the reference rates to be transparent and meet industry best practices for financial benchmarks”.

They also mention that “[t]he real-time index is suitable for marking portfolios, executing intra-day transactions and risk management.”

In conclusion, any benchmark or index related to the cryptocurrency market should be simple, transparent, flexible to changes, and easy to understand, and able to be applied to measure any portfolio performance compared to the index.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin