Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

According to data from the blockchain analytics firm intotheblock, 89.28% of Bitcoin addresses are currently in profit.

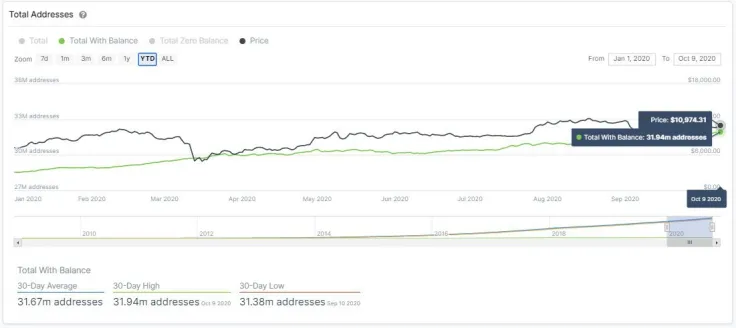

On-chain data show that there are 31.94 million addresses on the Bitcoin blockchain network with a balance. That means a total of 28.5 million Bitcoin addresses are in profit with the BTC price above $11,000.

A Mixed Sign: Why the Data Can be Analyzed as Both a Negative and Positive Factor

The analysts at intotheblock suggested that the figure is a positive factor for the medium-term price cycle of Bitcoin.

Since the overwhelming majority of Bitcoin holders are in profit, it could hint that the current Bitcoin price cycle is optimistic.

“There are now 31.94 million addresses with a balance in $BTC. Throughout 2020, the number of addresses with a balance in BTC has increased by 11.9%. And from those 31.94m addresses, 89.28% are profiting from their positions or "in the money" Bitcoin has a strong bottom,” the analysts said.

The data could also indicate that the price of Bitcoin has increased substantially throughout the past seven months to the point where most buyers are now in the positive.

But, one could analyze the data as a potentially negative statistic because it means buyers could want to sell BTC.

Whales often wait until their position is either breakeven or in profit to sell. If BTC drops below their entries, they tend to wait until BTC recovers.

Retail investors, in contrast, tend to have no specific pattern in selling or buying Bitcoin. For that reason, during times of extreme uncertainty, there are often capitulation phases.

On March 13, as an example, the price of Bitcoin crashed below $3,600. Most of the selling pressure came from a cascade of liquidations on futures exchanges, like BitMEX. While whales use futures exchanges, platforms like BitMEX are also used by many retail investors.

Still, there is a strong possibility that retail investors could be compelled to sell BTC while they are in profit.

There are many investors that have accumulated from the $3,000s to $11,000 since March. Whether that could lead to a take-profit pullback remains uncertain.

Bitcoin Selling Pressure From Retail Investors Fairly Low, For Now

In the near term, on-chain data suggests that retail investors are unlikely to move quickly to sell their Bitcoin holdings.

Bitcoin exchange reserves have continuously declined and the futures market’s open interest has also remained stagnant.

The two key figures back the argument of analysts that anticipate a stronger accumulation phase for BTC in the fourth quarter.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin