Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The enormous surge of Ethereum's price was not the most expected event, especially given the potential approval of the Ethereum ETF. However, with the most recent news, we might see it sooner than expected. As sentiment flipped from bearish to bullish, more than $250 million worth of shorts were liquidated in less than 24 hours.

On the technical front, Bitcoin's recent move has broken through key resistance levels, sending a strong signal to the market. The daily chart shows Bitcoin successfully surpassing the $67,000 mark, which acted as a significant resistance. This breakthrough has set the stage for Bitcoin to aim for the $70,000 level, a milestone that could solidify its position in bullish territory.

Ethereum's chart reveals a similar story. The cryptocurrency has managed to break past its 50-day and 200-day moving averages, indicating a strong upward momentum. The volume of trading has also seen a notable increase, suggesting growing investor interest and confidence in Ethereum's future prospects.

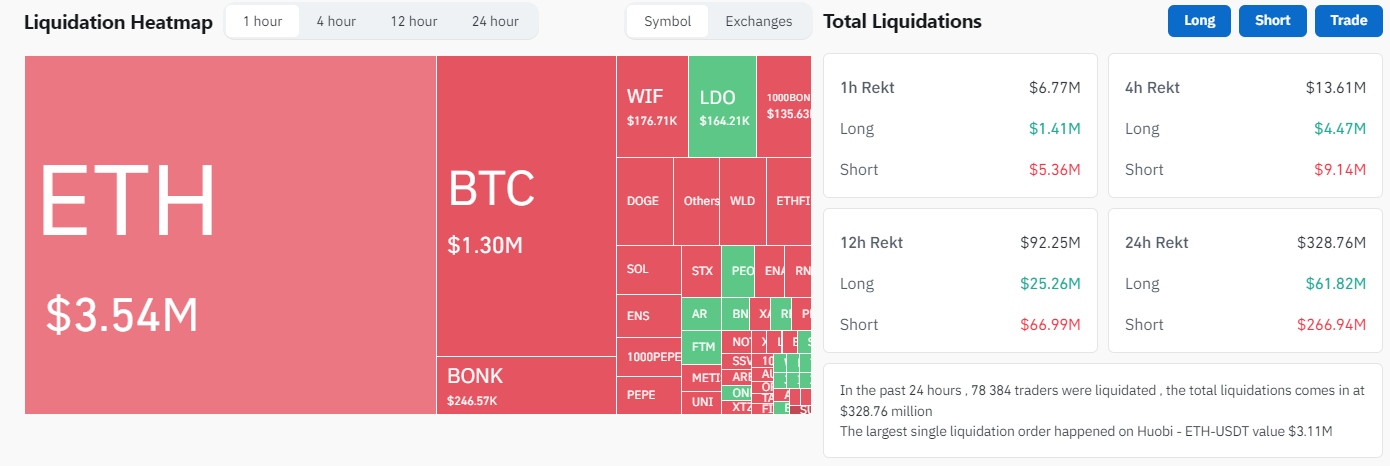

The impact of these price movements on the broader market has been profound. According to data, more than $250 million worth of short positions were liquidated as traders rushed to cover their positions amid the bullish trend. This massive liquidation has added further fuel to the rally, pushing prices even higher.

Interestingly, the liquidation data shows that the majority of these liquidations were short positions as, prior, to the Ethereum ETF news, the majority of the market was heavily inclined toward bearish sentiment.

The chart provided indicates that in the past 24 hours alone, $328.73 million were liquidated, with $267.06 million coming from short positions. In its current state, the market may in fact gain momentum and enter the second phase of 2024's bullrun.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov