Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Monday started with blood on the cryptocurrency market. According to data from CoinGlass, more than $500 million in long and short positions in crypto asset futures were liquidated over the past 24 hours. Interestingly, however, even in this tsunami of liquidations, there were some cryptocurrencies that showed not only stable but even discouraging price behavior. Over the past 24 hours, there were three such crypto assets - XRP, HBAR and IOTA.

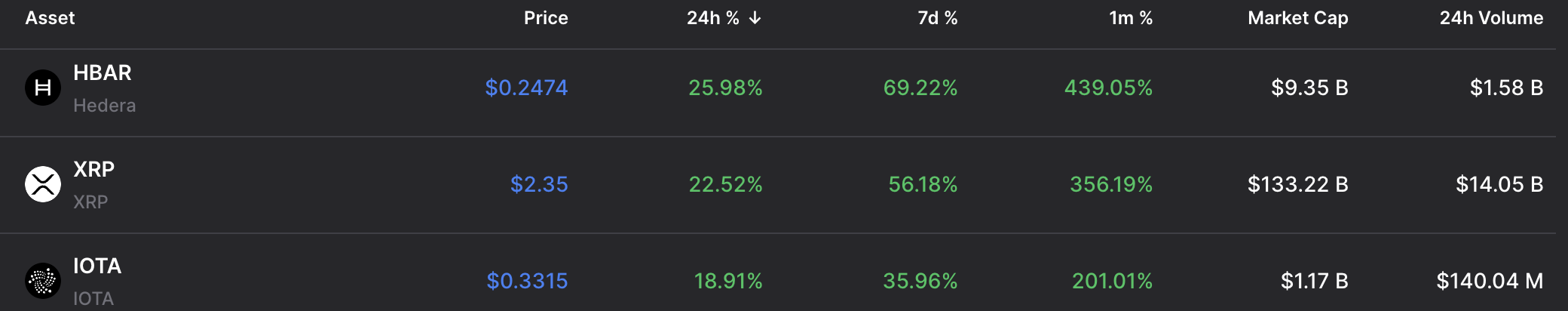

According to Dropstab's table of top performers, these cryptocurrencies increased their price by an average of 22% during this period. Interestingly, all of these digital currencies belong to projects that are more focused on working with businesses and crypto solutions for institutional investors.

It is likely that the revaluation of such assets was primarily set by XRP, which has seen a staggering growth of hundreds of percent over the past month, adding over $100 billion in capitalization and eventually becoming the third largest cryptocurrency right now.

Now, XRP can be called the headliner of this sector of enterprise-oriented cryptocurrencies, and all such assets are in a trend that positively affects their prices, even in times of increased market turbulence.

Market chooses to be "serious"

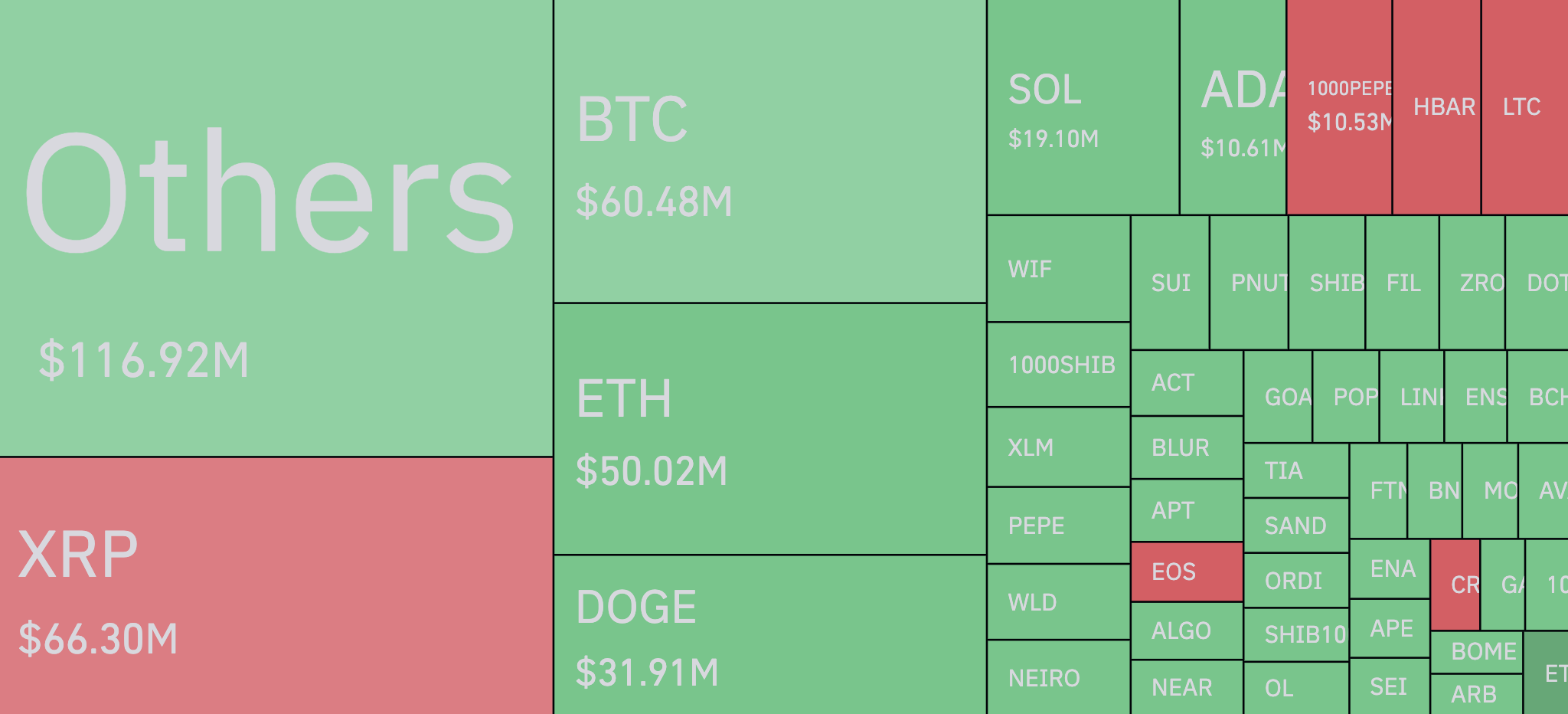

As for liquidations, judging by the CoinGlass heat map, we can see that investors and traders in meme cryptocurrencies are the most affected. This also confirms that "serious" projects like Hedera and XRP are now in the trend.

In addition, Bitcoin (BTC) and Ethereum (ETH) are at the top, which is not surprising given the phenomenon of these two major cryptocurrencies as market markers or indices.

Overall, however, bullish traders are most affected by this half-billion dollar wave of liquidation, with 63.3% of forced positions being long.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov