Solana (SOL), a popular alternative cryptocurrency and arguably one of the most hyped digital assets of the year alongside Bitcoin, saw a big spike in fund flows into ETPs based on the altcoin last week.

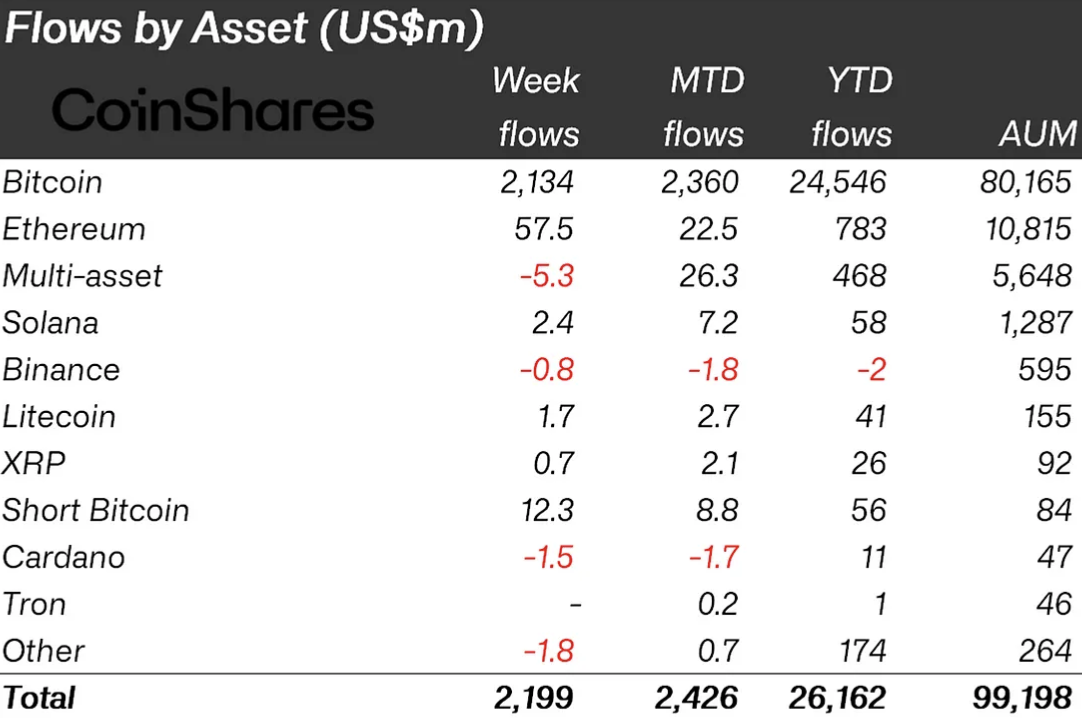

According to the latest report from CoinShares, investment products that allow exposure to the SOL token saw a 400% increase over the course of the week, totaling $2.4 million.

The gain adds to the total inflows into Solana ETPs, which have reached $58 million year-to-date. This is far less than its two main counterparts, Bitcoin (BTC) and Ethereum, but still more than any other altcoin.

However, with the price of SOL up over 63% and ETH up just 19%, it seems unfair that their fund flow figures differ by 1,350%, with the advantage going to the latter.

What may change this perspective is the Solana ETF solution, which is heating up as the year draws to a close, with applications for such an investment vehicle already being made by the likes of Bitwise and VanEck.

When Solana ETF?

The launch of the ETF could provide greater opportunities to the market and promote such investment products, paving the way for Solana to access larger pools, audiences and liquidity.

As the inflows show, the demand is there. All that is missing at the moment is the regulatory "green light" as the SEC has rejected initial 19b-4 forms due to concerns that the SOL token may be classified as a security. Once this hurdle is cleared, we may see the approval of the Solana ETF and how the imbalance in flows between SOL and ETH will change.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov