Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

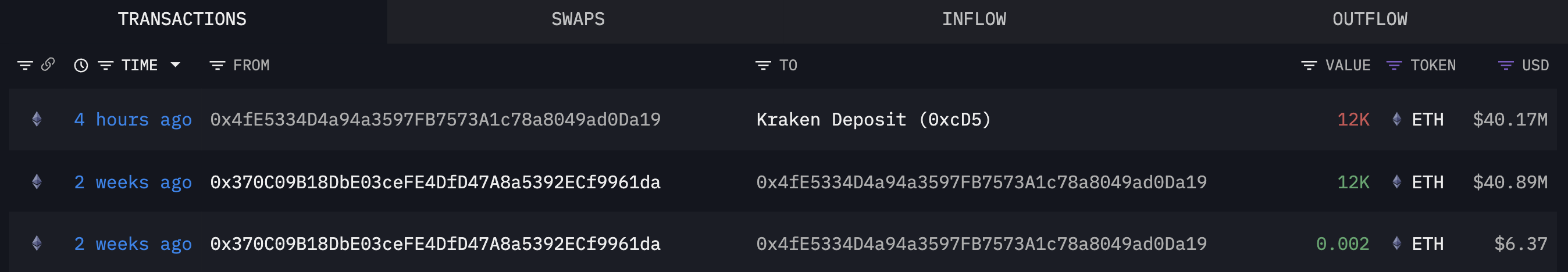

This afternoon, an unknown large entity transferred 12,000 ETH worth around $40 million to a major U.S.-based exchange, Kraken.

According to on-chain data from Arkham Intelligence, the anonymous whale, as large investors are often referred to in the crypto space, previously deposited the same amount from address "0x370." The latter is considered to be a sender address with links to many other addresses, including Kraken's hot wallet.

Now the whale has deposited this amount of Ethereum back into Kraken. Whether they are preparing to sell it or not is an open question. Such transfers are often seen as a bearish event - when a large entity deposits a lot of coins to an exchange in order to sell them.

While this may not be the case here, it could sour sentiment or even prompt smaller players to unload their ETH holdings in order to hedge their bets.

Ethereum: Price and ETF

Amid this activity, the crypto community is eagerly awaiting news of Ethereum ETF approvals, anticipated this week.

Despite expectations that July 4 will mark a crucial deadline, no announcement has yet been made, which might have influenced the whale's decision to move their assets.

Currently, Ethereum's price is rising, up 3.4% to $3,357 per ETH. However, strong resistance remains above this level, complicating further upward movement. The recent price surge of over 10.5% last week may have created an opportune moment for the whale to sell, particularly as Ethereum approaches this critical price point.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov