Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

There may be trouble ahead for Shiba Inu that has been a noticeable decline in its large transaction volume. Whales' SHIB transaction volume has fallen below 500 billion SHIB in the last day, according to on-chain data, and is now at 365.69 billion SHIB.

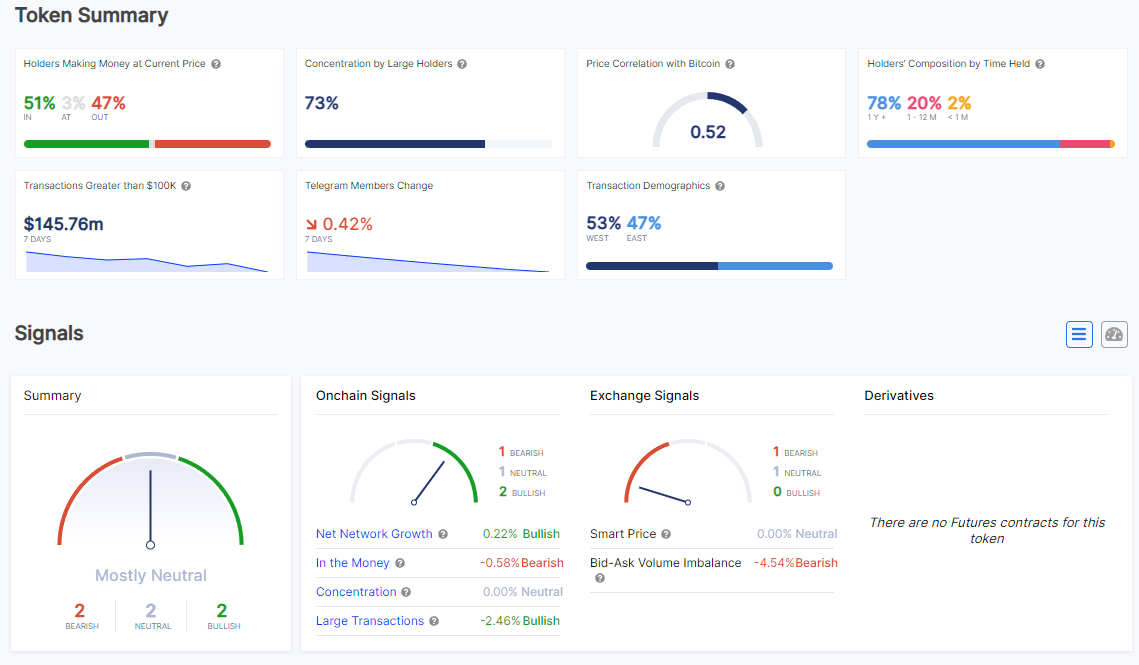

Significant liquidity problems and even a price reversal could result from this decline in the near future. With only 15 transactions recorded, the number of large transactions has also decreased to its seven-day low according to an analysis of the on-chain metrics. Compared with the seven-day high of 75 transactions on July 22, 2024, it is a significant disparity.

Whale activity has significantly decreased, which is bad news for the price and liquidity support since it is reflected in the decline in both transaction volume and the number of large transactions. A descending wedge pattern has been formed by SHIB's price action, according to the price charts provided.

If the price breaks above the upper trendline, this pattern frequently indicates the possibility of volatility and, in many cases, a bullish breakout. But the state of SHIB right now paints a conflicting picture. The price has been settling in and has had difficulty rising above the important moving averages, which serve as barriers.

SHIB's risky position is highlighted by the technical indicators. SHIB must cross both the 50-day EMA and the 100-day EMA in order to indicate a bullish reversal. At the moment, the price is trading close to the lower bound of the falling wedge, indicating that should the bearish attitude hold, the downtrend may continue.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov