Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

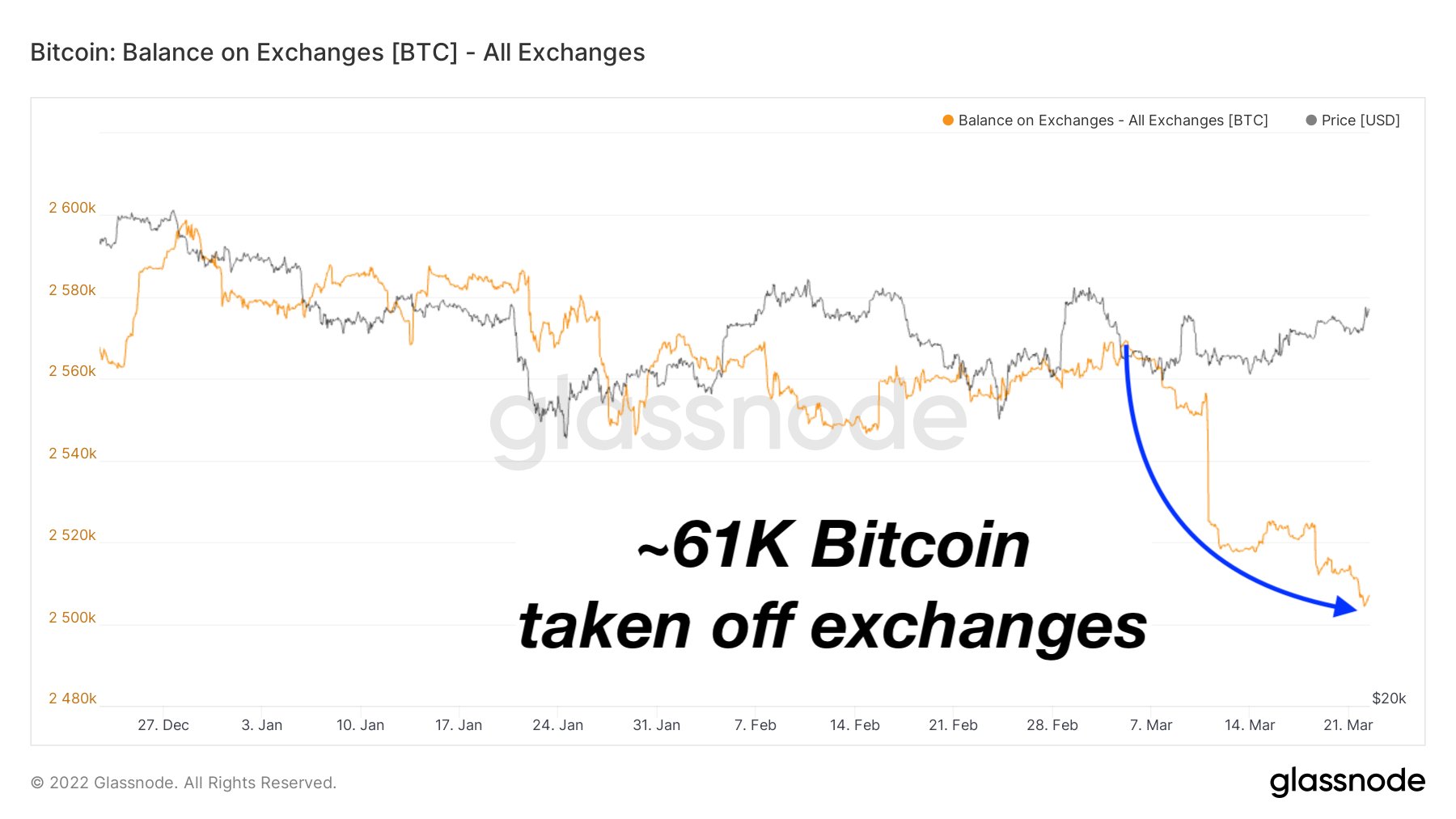

A massive volume of BTC left centralized exchanges tracked by Glassnode in March. According to the on-chain data provided, traders and investors removed approximately 61,000 BTC from trading platforms to their private wallets or exchanged the cryptocurrency for fiat.

Investors losing trust in exchanges

One of the main reasons for the increased exchange outflows could be tied to the general drop in trust in centralized and decentralized exchanges. While the constant danger of becoming a victim of hackers still exists in the space, it may not be the main reason for large funds outflows.

Account limitations and overregulation were among the hottest topics in the space as large exchanges started closing certain accounts on their platform. The CEO of the Kraken Exchange, who warned his users about potential regulation coming to cryptocurrency exchanges and urged users to withdraw their funds to private wallets, added more fuel to the fire.

Most cryptocurrency exchanges in the space use hot wallet technologies and store the private keys of users' wallets on their service or certain databases, which are often attacked by hackers. But even when exchanges properly defend their clients' property, they still have to follow orders from regulators in the countries they function in.

Traders choose alternative options

Because of the questionable performance of the cryptocurrency market since the end of 2021, a large portion of traders and investors switched to alternative ways of earning money in the industry like liquidity farming, staking and others.

Recently, the Ethereum network celebrated a new milestone with 10 million ETH locked in the Ethereum 2.0 staking contract as the blockchain comes closer to the full switch to the PoS network.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team