Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

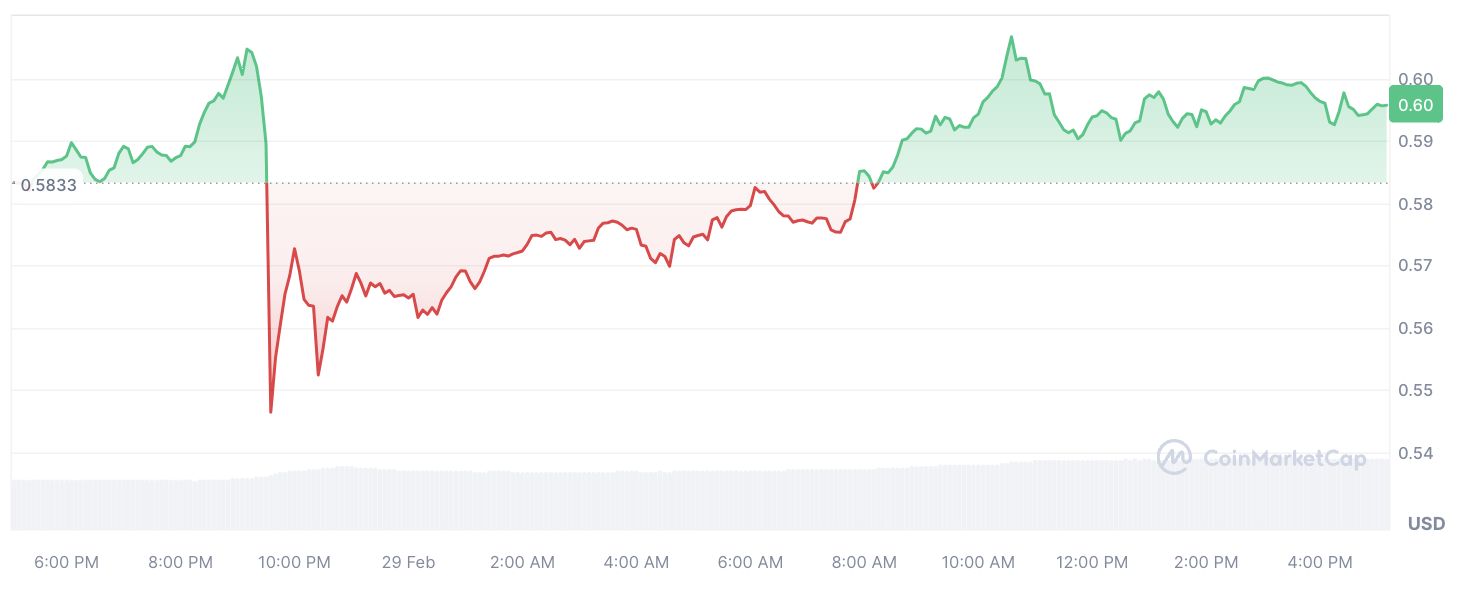

Amid today's tumultuous trading session on the crypto market, XRP, one of the foremost tokens by market capitalization, has seen a remarkable surge of over 3.5%. This surge coincides with a notable spike in trading volume, as reported by CoinMarketCap, indicating a staggering 43% increase compared to the previous day, totaling an impressive $3.76 billion.

However, stealing the spotlight in today's market activity is the news surrounding South Korea's leading cryptocurrency exchange, Upbit. Reports from Whale Alert have unveiled a significant withdrawal of 18 million XRP tokens, valued at approximately $10.7 million. The tokens were swiftly transferred to an undisclosed wallet, leaving observers pondering the motives behind this substantial movement.

Such substantial withdrawals from exchanges often hint at strategic accumulation or storage of assets in separate wallets, suggesting potential bullish sentiment among investors. Conversely, movements of tokens toward exchanges typically indicate a predisposition toward selling.

Amid this significant withdrawal, XRP's upward trajectory remains unwavering, with its price soaring to $0.596 following the transfer. Notably, XRP commands a significant share of trading activity on Upbit, accounting for 5.61% of the exchange's total turnover and securing the fourth position in terms of trading volume on the platform.

This substantial influx of trading volume and the notable withdrawal from Upbit underscore the burgeoning interest and activity surrounding XRP, even amid broader market volatility.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin