Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

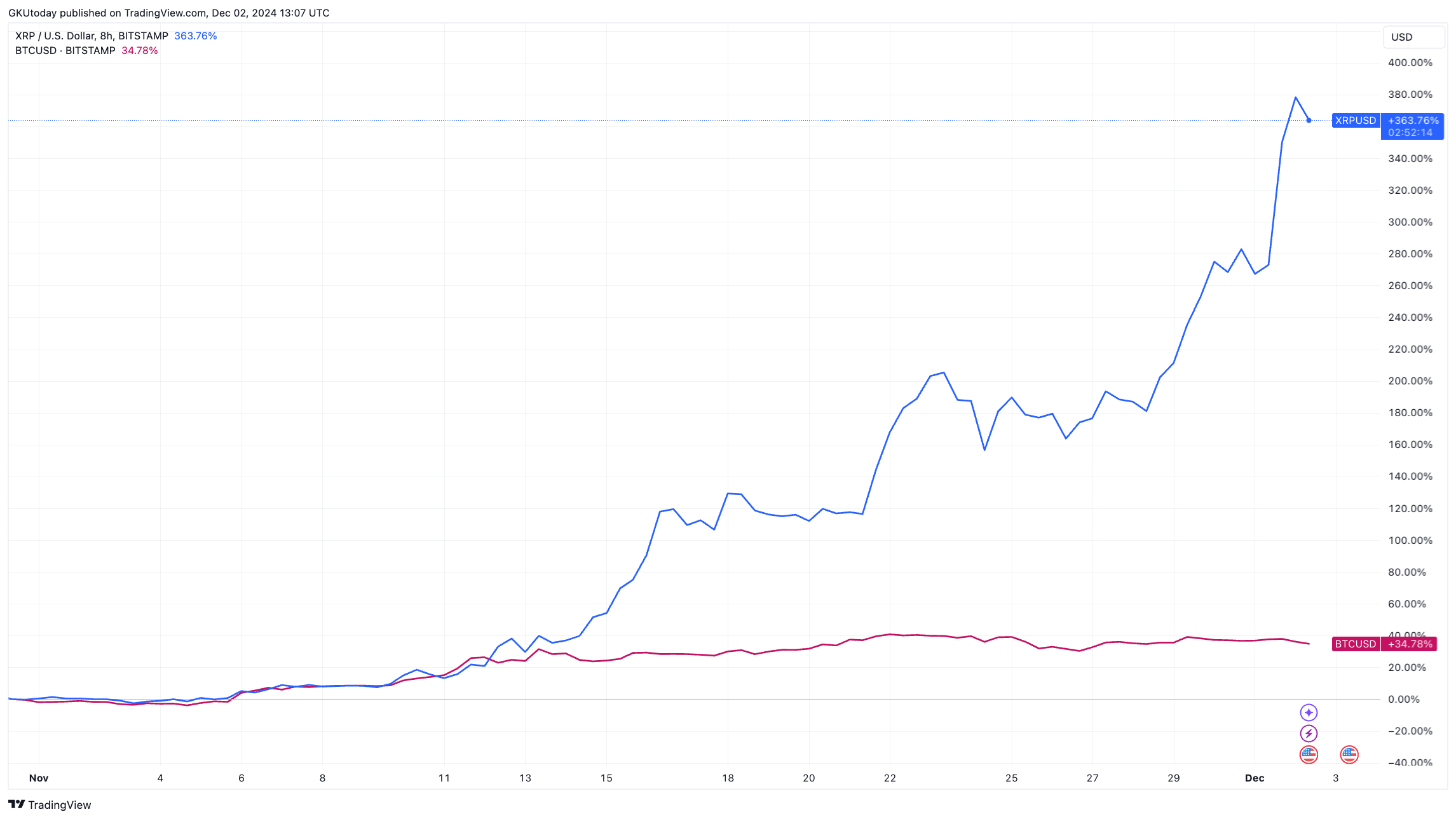

For weeks, XRP’s price performance has been at the center of attention on the crypto market. Hitting $2.50 at the start of December and posting a staggering, almost 400%, gain since the U.S. election last month, the token has climbed into a dominant position. Now valued at over $135 billion in market capitalization, XRP stands as the third-largest digital asset, behind only Bitcoin (BTC) and Ethereum (ETH).

In the middle of this, an unexpected yet intriguing question emerges - whether XRP can eventually overthrow Bitcoin NEXT? A trader-expert known in the crypto space under the nickname "DonAlt" stood up to answer that question.

Noting that XRP's fully diluted valuation (FDV) is now double that of Solana and rapidly approaching Ethereum, DonAlt has drawn parallels to 2017, when XRP briefly overtook Bitcoin.

However, he cautions that while such growth may excite optimists, going too far could destabilize the market as it did then. DonAlt suggests that even a realistic upside scenario, such as a 1,000% increase, could lead to catastrophic corrections if the market fails to maintain balance.

Be careful what you wish for

Adding another angle to the discussion, renowned trader Peter Brandt recently shared a more bullish perspective. Brandt thinks XRP could eventually reach $24 per token, which would elevate its market cap to $1.37 trillion. This figure, while still trailing Bitcoin's current $1.89 trillion, puts XRP within close reach of challenging the market leader's dominance.

But there is still a bit of skepticism out there. Looking at what has happened in the past and what is going on in the market right now, it is clear that growth like this needs to be managed carefully. There are a lot of risks involved, and the 2017 market crash is a good example of what can happen if things get out of control.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov