Ripple’s XRP is making waves once again following recent legal victories and technological advancements in the crypto space, according to CoinDesk. British multinational bank Standard Chartered now predicts that XRP could hit $12.50 by the end of 2028, in what could be a historic run for the digital asset.

Geoffrey Kendrick, the bank’s Global Head of Digital Assets Research, issued a detailed price projection that envisions XRP rising to $5.50 in 2024, $8 in 2026, $10.40 in 2027, and ultimately $12.50 by the end of 2028.

This trajectory suggests a more than 500% increase over the next three years. Standard Chartered also predicts that XRP could overtake Ethereum in market capitalization, potentially making it the second-largest cryptocurrency by late 2028.

XRP ETF launch fuels optimism

This bold price call came shortly after the launch of the first-ever XRP ETF in the U.S. However, the ETF comes with a twist as it does not provide direct exposure to XRP. Instead, it is based on swaps that mirror XRP’s performance, making it a unique offering in the digital asset space.

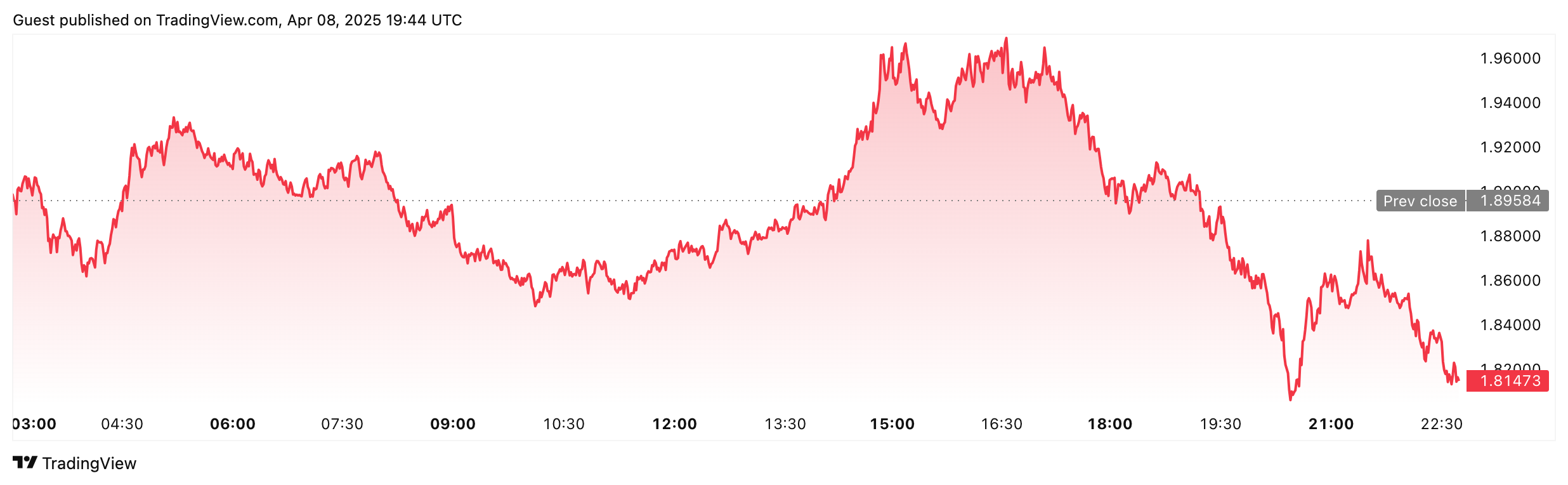

Despite the launch, XRP remained in the red, registering a 4% price decline in 24 hours. The coin, currently the fourth-largest by market cap, has been showing high volatility and hasn’t yet responded to the ETF news.

Still, Standard Chartered remains bullish. The bank argues that XRP’s real-world utility is a critical driver of long-term growth. XRP has been increasingly adopted across financial institutions in multiple countries for faster and cheaper remittances.

Investor confidence in XRP has also been boosted by favorable legal outcomes. Most notably, the U.S. Securities and Exchange Commission (SEC) recently dropped its appeal in the long-standing case against Ripple Labs, removing a major cloud of uncertainty that had weighed on XRP’s price.

With legal clarity, a new ETF product, and increasing use cases in international finance, XRP may finally be on the path to realizing the ambitious projections set by Standard Chartered.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov