Amid a chaotic period for cryptocurrencies, XRP has emerged as a focal point of attention, experiencing a staggering surge in liquidations within a short span. Recent hours have witnessed an unprecedented increase in the liquidation of positions in XRP, as the broader crypto market grapples with substantial losses.

CoinGlass data reveals a stark picture, with liquidations of XRP positions soaring to $986,530 in just the past four hours alone. Alarmingly, a staggering 99.38% of these liquidations represent long positions, indicating a significant exodus of bullish sentiment. The intensity of liquidations intensified further within the last hour, witnessing a notable spike of 1,868%, totalling $933.73.

Delving deeper into the statistics shows a distressing trend. Over a 12-hour period, liquidations skyrocketed to a staggering $1.61 million, with short positions accounting for a mere $166,420.

In the broader scope of 24 hours, XRP derivatives liquidations reached a staggering $2.73 million, with a whopping 90.5% of the liquidated positions representing longs and only 9.5% being shorts. The numbers paint a grim picture for XRP bulls, who faced significant setbacks within the past day.

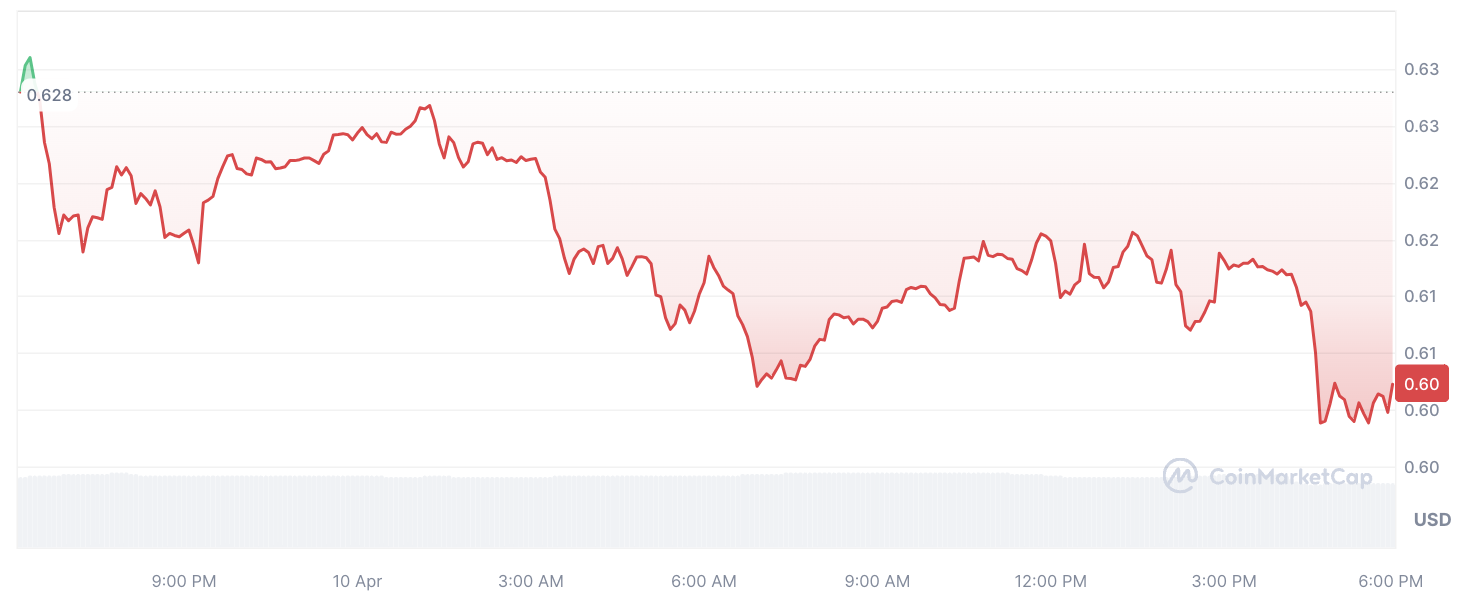

Simultaneously, XRP's price trajectory has mirrored this tumultuous activity on the market. Following a bullish trend throughout the preceding day, XRP abruptly reversed course, witnessing a 3.31% decline in value. This downturn brought the price to $0.587, a seemingly modest drop that nonetheless proved sufficient to trigger liquidations amounting to nearly a million dollars within a single hour.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov