In a week full of ups and downs for digital assets, XRP stole the spotlight with a whopping $95 million in inflows, marking the highest weekly total ever recorded by CoinShares for investment products based on this popular cryptocurrency. This 621% week-over-week increase is a great example of how the token is attracting more and more attention, especially as financial market participants are talking more and more about U.S.-based ETFs on XRP.

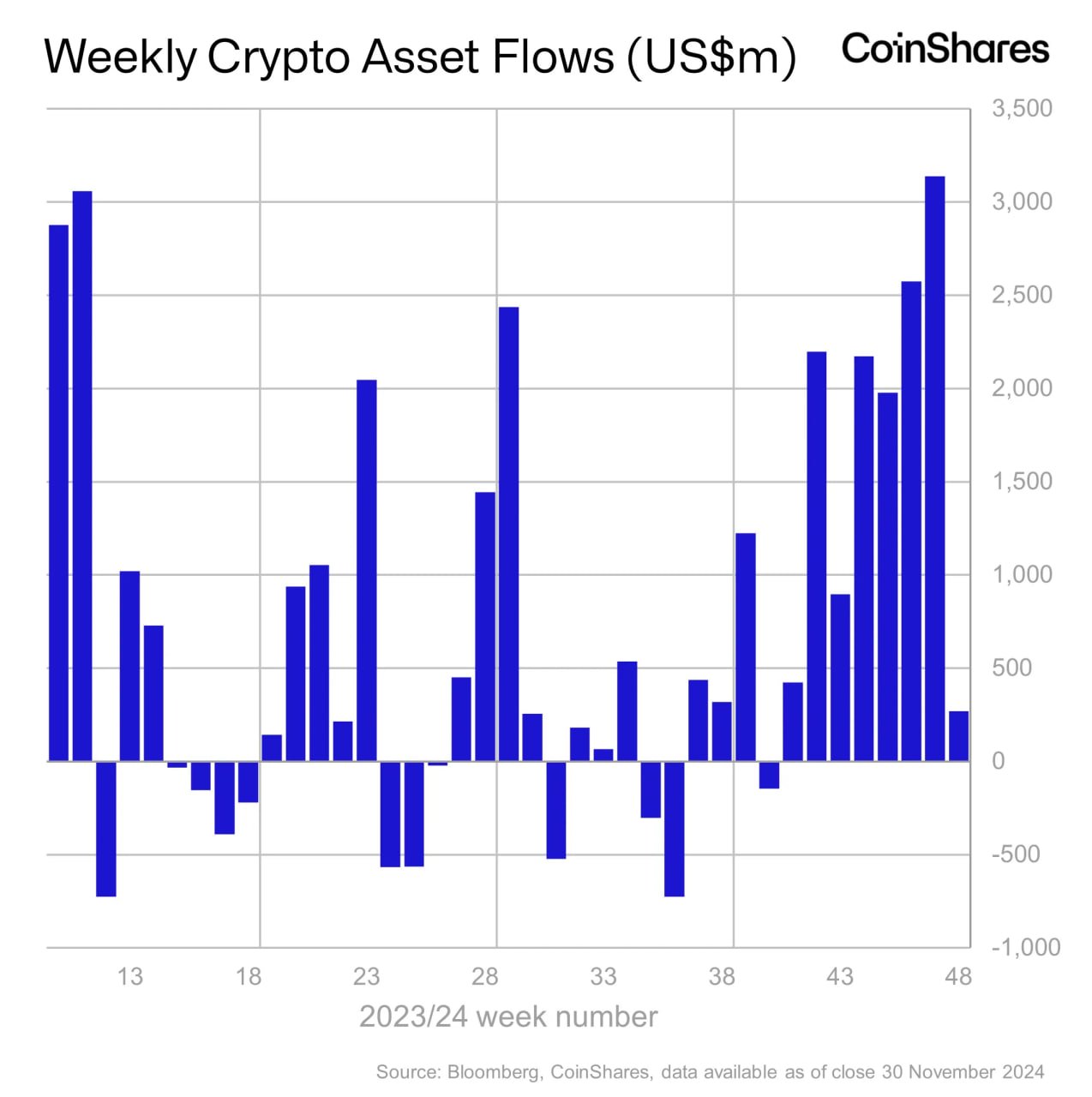

It is worth noting that digital asset investment products attracted a total of $270 million in inflows last week, which is quite remarkable in the broader context of the crypto market.

But it was the performance of XRP that really caught people's attention. It is now the third largest digital asset by market capitalization, valued at over $135 billion. XRP's price is up to $2.50, which is a nearly 400% increase since last month, and that is fueling even more interest in the asset.

Bitcoin, despite its dominant status, had a contrasting week with $457 million in outflows, which experts say was due to profit taking after reaching the symbolic $100,000 price level.

Ethereum also made headlines by securing $634 million in inflows, reaching a year-to-date record of $2.2 billion and surpassing its 2021 peak. With all this in mind, it is even more impressive how much XRP is attracting investment.

As mentioned above, much of this growth can be attributed to what's happening in the ETF space. With companies like WisdomTree, 21Shares and Canary Capital filing with the SEC for an XRP ETF, it looks like it is getting closer to becoming a reality.

WisdomTree's filing, with the Bank of New York Mellon as the trust's administrator, is particularly noteworthy. There is also excitement around combination crypto ETFs from Bitwise and other firms that include XRP with other major coins.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov