The XRP community is anxiously awaiting a statement from Ripple regarding the failed Silicon Valley Bank (SVB) and Ripple's exposure to it.

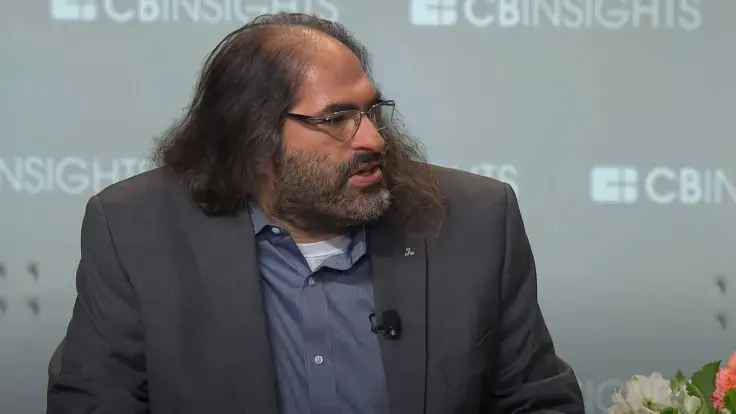

Ripple CTO David Schwartz recently tweeted that the San Francisco-based company would issue a statement soon.

"We will issue a statement soon. I can't really say anything until we do," he said.

In a series of tweets, the Ripple executive questioned the cause of Silicon Valley Bank's collapse. Schwartz said he did not understand how a bank could become insolvent due to a run, as its assets and obligations would not change in such an event.

He suggested that the bank was already insolvent and was not tracking its obligations correctly. Schwartz also noted that the bank's failure to mark-to-market its long-term treasury holdings contributed to its insolvency.

The XRP community is divided in their opinions on Ripple's potential exposure to the failed Silicon Valley Bank (SVB). Some speculate that Ripple may have been affected, while others believe Ripple could potentially buy parts of SVB or be part of a liquidity solution.

Its members are concerned about the potential impact on the value of XRP, with some pledging not to sell their XRP if Ripple confirms its exposure. Despite differing opinions, there is shared concern about the situation and frustration at the lack of information from Ripple.

Some members have also expressed disappointment with the lack of realistic thinking from certain XRP holders.

The recent collapse of two US banks, coupled with the blow of SVB and Silvergate, has left the cryptocurrency market in disarray, with Circle reporting $3.3bn of its reserves inaccessible.

The value of its USDC token has plummeted, worsening the existing problems faced by the cryptocurrency market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov