InsurAce, a leading decentralized insurance protocol, seeks to provide insurance services to DeFi users, allowing them to secure their investment funds against various risks. DeFi insurance or Decentralized Insurance is the process in which the platform prevents its users from potential losses due to hacking, smart contract bugs, or other such digital fraudulent activities. DeFi insurance also provides immediate redemption of tokenized crypto and risk assessments.

It is reputed to be the first in the industry to offer cross-chain portfolio-based covers while enabling users to get low premiums. InsurAce's product went live on Ethereum in April 2021 and currently has built a full-spectrum cross-chain insurance product line, covering protocols, CEX, and IDO platform running on Ethereum, Solana, BSC, Heco, Polygon, and Fantom.

On June 17, InsurAce announced its deployment on Binance Chain, making it the first insurance protocol to launch on both Ethereum Network and Binance Smart Chain. By deploying on both BSC and ETH, InsurAce aims to provide insurance with more flexibility and lower fees.

Through this, users will be able to earn BEP-20 INSUR tokens for mining, insure their assets with BSC tokens through the InsurAce app, and their ERC-20 INSUR tokens for BEP-20 INSUR tokens. This also offers the opportunity to trade INSUR tokens on Pancake Swap. INSUR, the native token of the InsurAce platform, has a growing market cap of nearly $20 million with 16.7 million INSUR tokens as a circulating supply.

Why Does the DeFi Ecosystem Need Insurance?

DeFi is a blockchain-based technology that has removed the need for financial mediators by replacing them with smart contracts. Among many decentralized financial services are decentralized insurance services, which are not given much attention but are of great importance, and gainiing awareness rapidly.

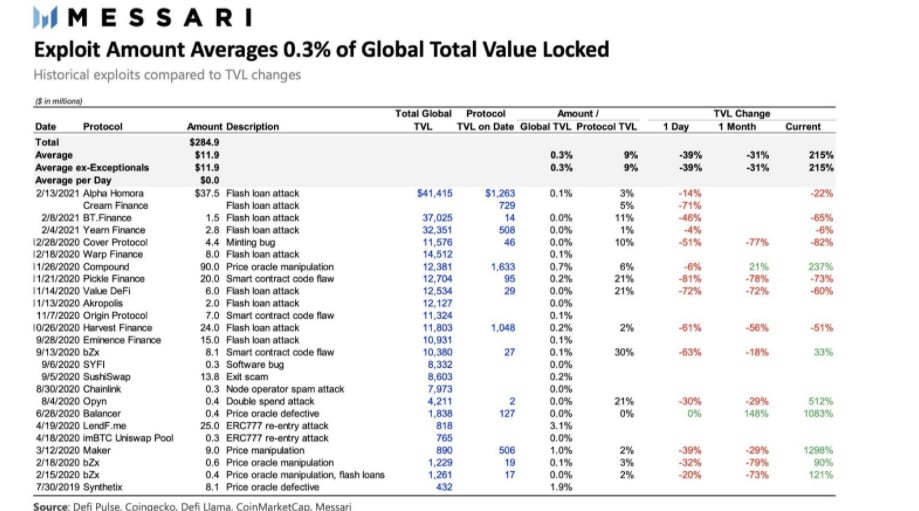

Given the DeFi sector's surge into prominence since 2019, it has become a target for hackers and cyberpunks. In February 2021, data aggregator Messari estimated that over $284 million in DeFi was lost to hacks since 2019. By the end of April 2021, major crypto thefts, hacks, and frauds totaled $432 million, $240 million (55.4%) of which is directly related to DeFi hacks or fraud. These growing statistics highlight the keen necessity for insurance against cryptocurrency crimes in DeFi.

The latest news which made headlines recently was that of Iron finance's native token TITAN which crashed by almost 100% from its all-time high of $64.04 within two days to reach near $0. The near-total collapse in the price of a share token of decentralized finance (DeFi) protocol was “the world’s first large-scale crypto bank run,”

Ethereum is the second-largest cryptocurrency platform. According to 2018 research, more than 45% of Ethereum smart contracts are vulnerable to hacking. DeFi hacks are not only restricted to the Ethereum Chain as the Binance Smart Chain environment is also clocking similar incidents. With growing activity on BSC, DeFi protocols on the network have also fallen victim to rogue actors using familiar attack vectors.

InsurACE aims to give DeFi users protection over their funds with more than 40 protocols protected by InsurAce. Among the listings include Thorchain, Convex Finance, Sushiswap (Ethereum and v1 Polygon). Users can choose insurance for their wallets and smart contracts so that they do not leave empty-handed in case of a hack.

Denys Serhiichuk

Denys Serhiichuk Tomiwabold Olajide

Tomiwabold Olajide